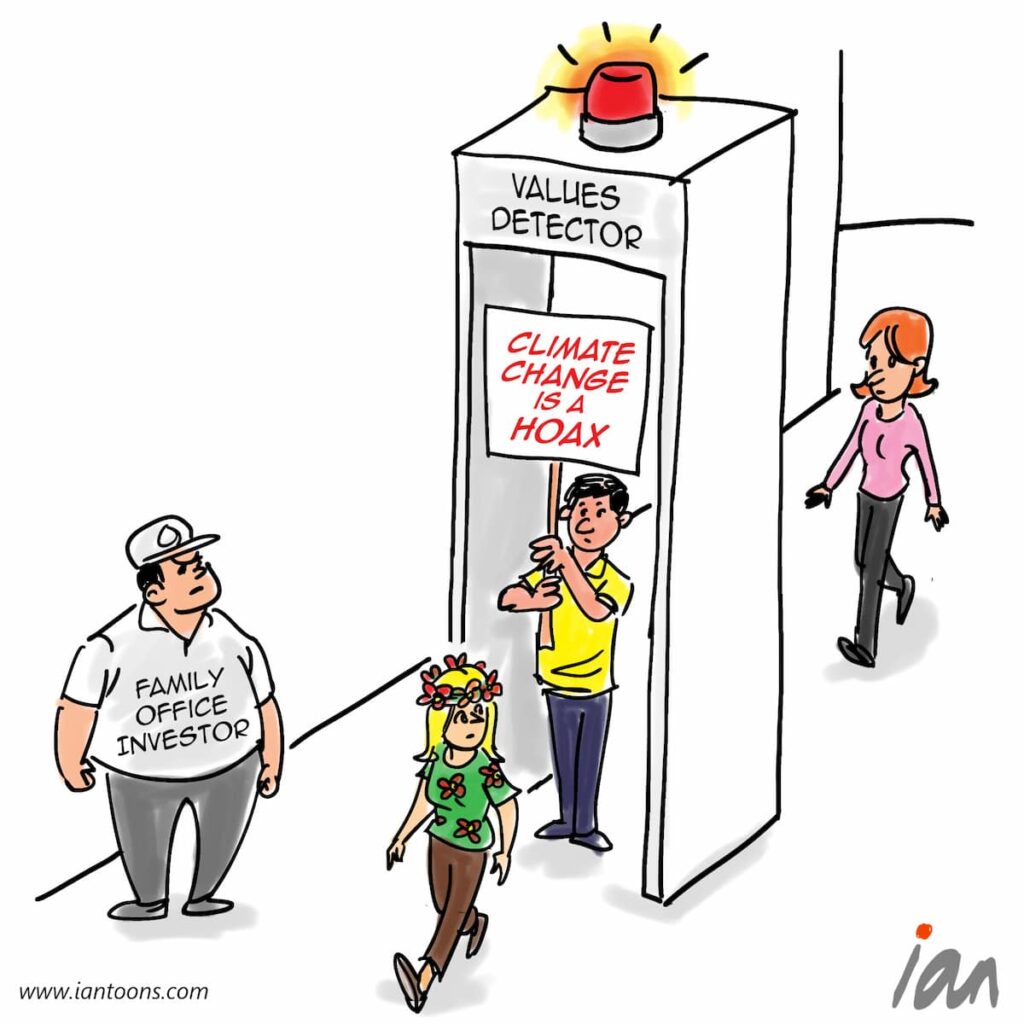

Values Investor

“Values Investor” – a cartoon that illustrates the best way to engage with Family Offices when looking for capital.

According to Deloitte Private, Single Family offices, defined by the in-house investment and service firms of families typically worth $100M or more, are expected to top $5.4 trillion in assets by 2030, projecting them to have more assets than hedge funds.

This class of capital is important for the technology industry, with PwC noting that almost one-third of the total capital invested in startups worldwide comes from family offices and Kauffman Fellows reported that family offices take a “large role as limited partners (LPs) in first-time, emerging fund managers.

Finding these investors is often half the problem as they rarely come to conferences and tend to not be active on social media.

Also, the engagement should be nurtured over time and map to the family office’s values. As Mr Family Office, a newsletter to 3,500 family offices said, “be patient. Don’t push for a quick win. Focus on building a genuine relationship, and the rewards will follow.”

Also, many family offices were set-up with a set of values or a philanthropic purpose, which requires researching prior to any pitch.

Ron Diamond, founder of Diamond Wealth, said that the upside of receiving investment from Family Offices is that “they are not incentivized to flip companies as quickly as venture capital firms, offering greater alignment between founders and capital.”

14

1

1