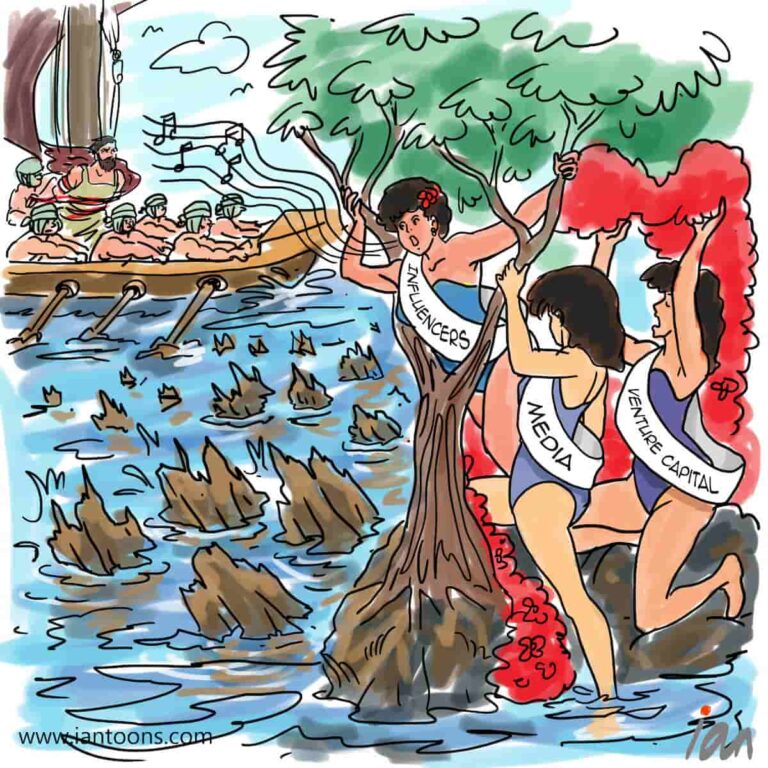

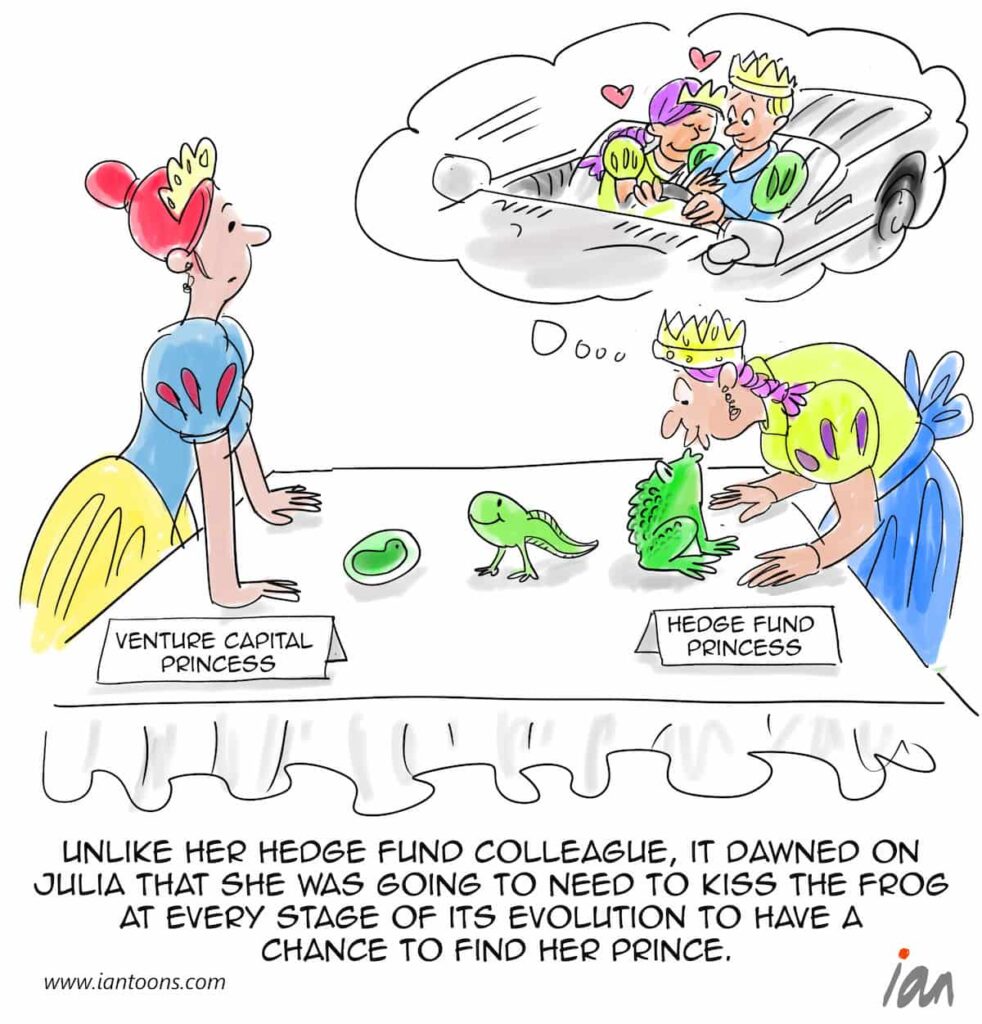

Dreaming of a Prince

“Dreaming of a Prince” – a cartoon that illustrates why hedge funds are moving into venture.

In 2021, some of the most active firms investing in early-stage startups were hedge funds (e.g. D1 Capital Partners, Tiger Global), which historically have invested in more liquid assets.

For example, D1 decided to allocate 35% (or $11 billion) of their fund to private investments.

Hedge funds realized that they could use their large capital bases to take successful startups from their $100M stage at IPO through to multi-billion publicly traded company that dominates its sector (e.g. Warby Parker, Cazoo).

As a result, traditional venture firms are being squeezed down to early stage investing so that they can secure pro rata rights for later stage investment rounds in the most attractive startups.

17

2

0