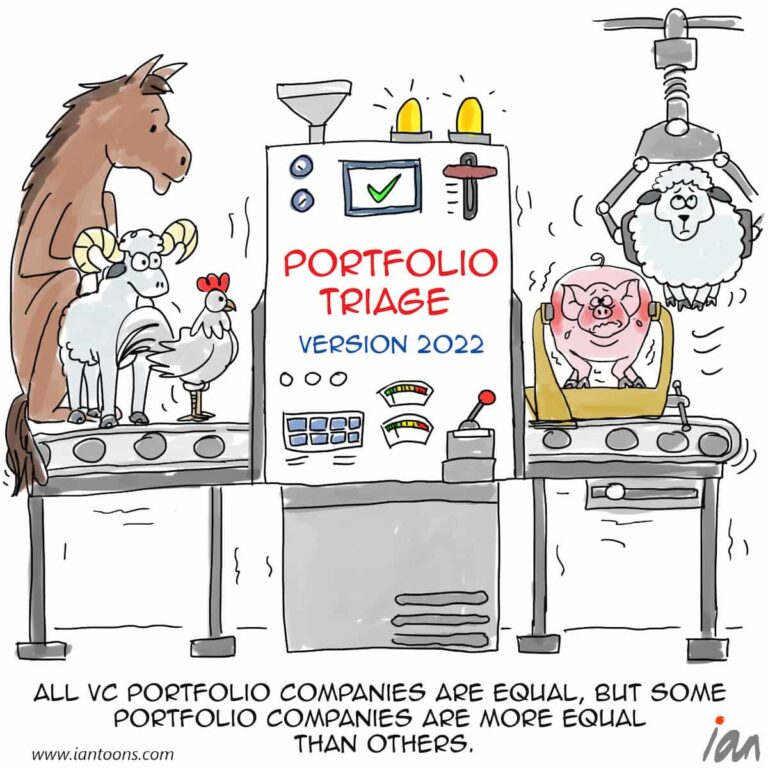

A La Carte

“A La Carte”– a cartoon that illustrates how the drop in easy venture capital money may well result in feisty new Fintech startups becoming acquired or forced to merge.

Throughout the last 10 years, Fintech’s have talked a big game about how they will take market share from the incumbent players and address underserved niches.

However, their impact has been negligible – for example, the largest Neobank in the US has only 13M customers or less than 10% of the market and the largest digital lenders have less than 5 million customers each.

With the venture capital faucet turning off and low customer numbers/revenue, we may now see many Fintech’s acquired by incumbents (e.g. banks) and well-funded adjacent market entrants (e.g. Paypal, Intuit).

The acquisition rationale will likely be acquiring product innovation and talent, rather than market share, so expect the acquisition multiples on revenue to be high single digits (not the 20x we saw in 2021).

17

2

0