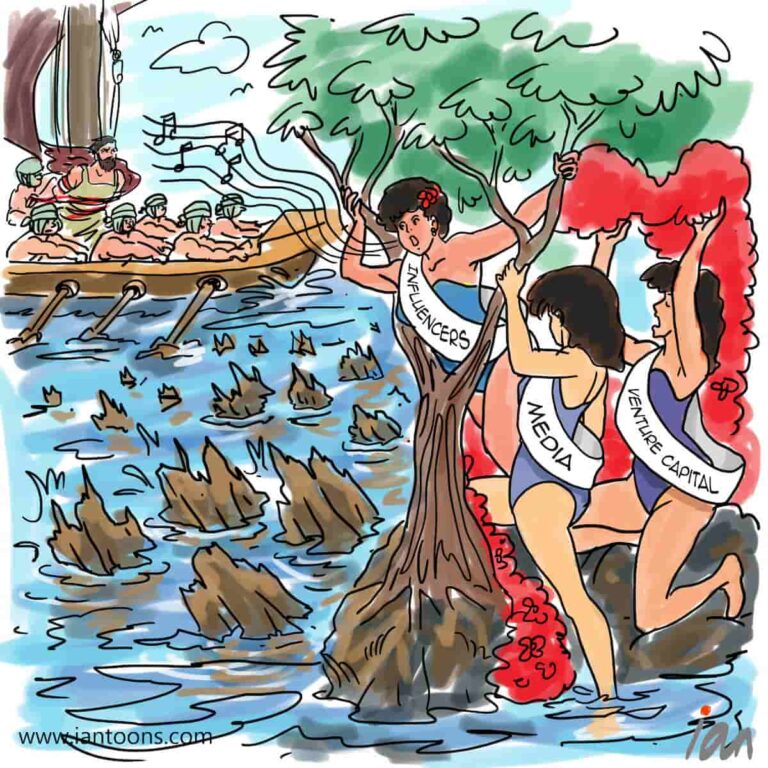

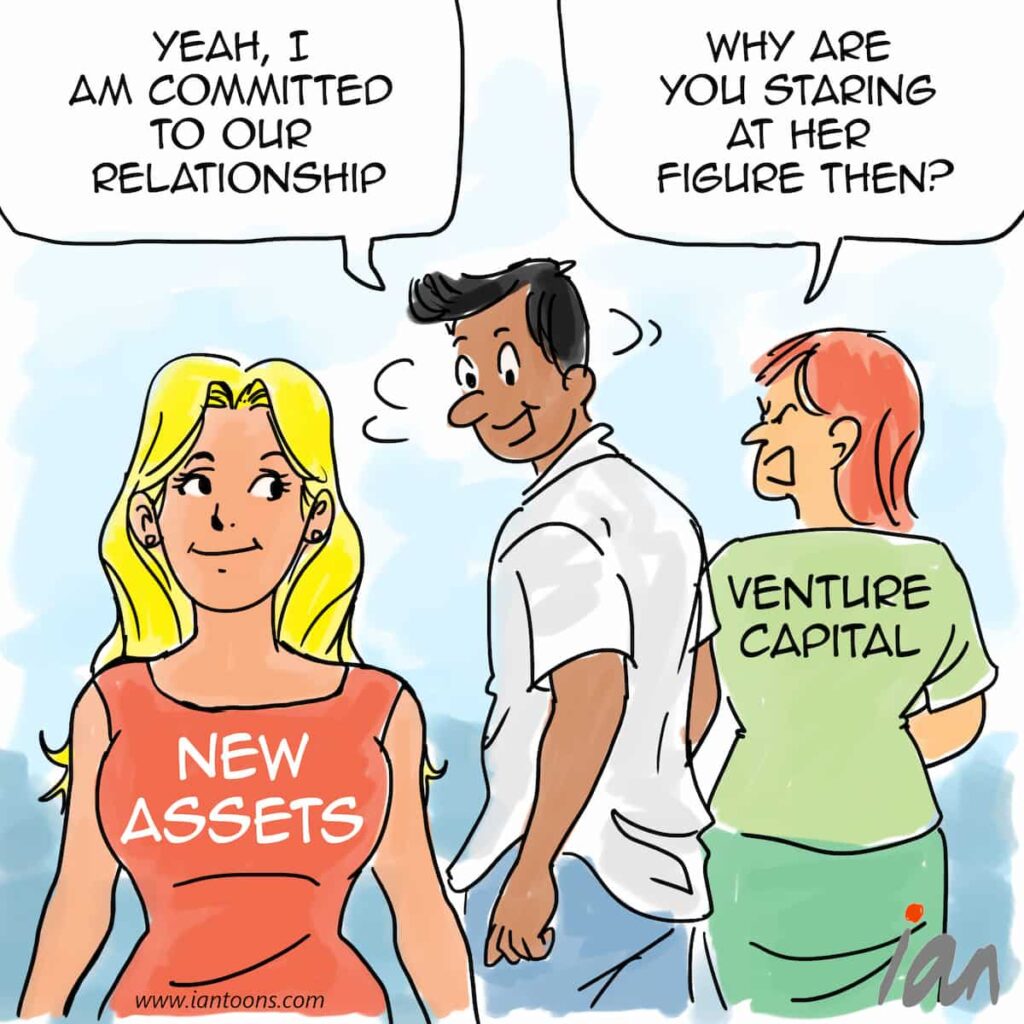

Attractive Figure

“Attractive Figure” – a cartoon that questions whether institutional Limited Partners (e.g. pension funds) will continue their historically high allocation of investments into Venture Capital as an asset class.

One of the largest pension funds, CalPERS with $469BN in assets under management invests 8.3% into private equity, of which venture capital is a portion.

At the start of 2022, TrueBridge Capital did a study that found that 90% of Limited Partners would either maintain or plan to increase their venture capital exposure in the year ahead.

However, some of the underlying assumptions behind this commitment have shifted in the last nine months.

The last 5 years were characterized by low-interest rates, which sent all investors on a hunt for yield by seeking riskier assets. Some Limited Partners started making their own direct investments in startups (e.g. CalSTRS), while others allocated their capital to venture funds focused on a single high-risk asset class (e.g. blockchain-only funds received $30BN in 2021).

With the market for venture capital showing declining valuations and less chance for exits (the last IPO over $50M was over 230 days ago), the increase in interest rates in the US has made more traditional assets more attractive.

In high inflation environments, pension funds will likely start to reallocate from venture capital to distressed asset private equity funds or shift out of the high-risk asset class altogether to invest in commodities or REITs.

19

2

0