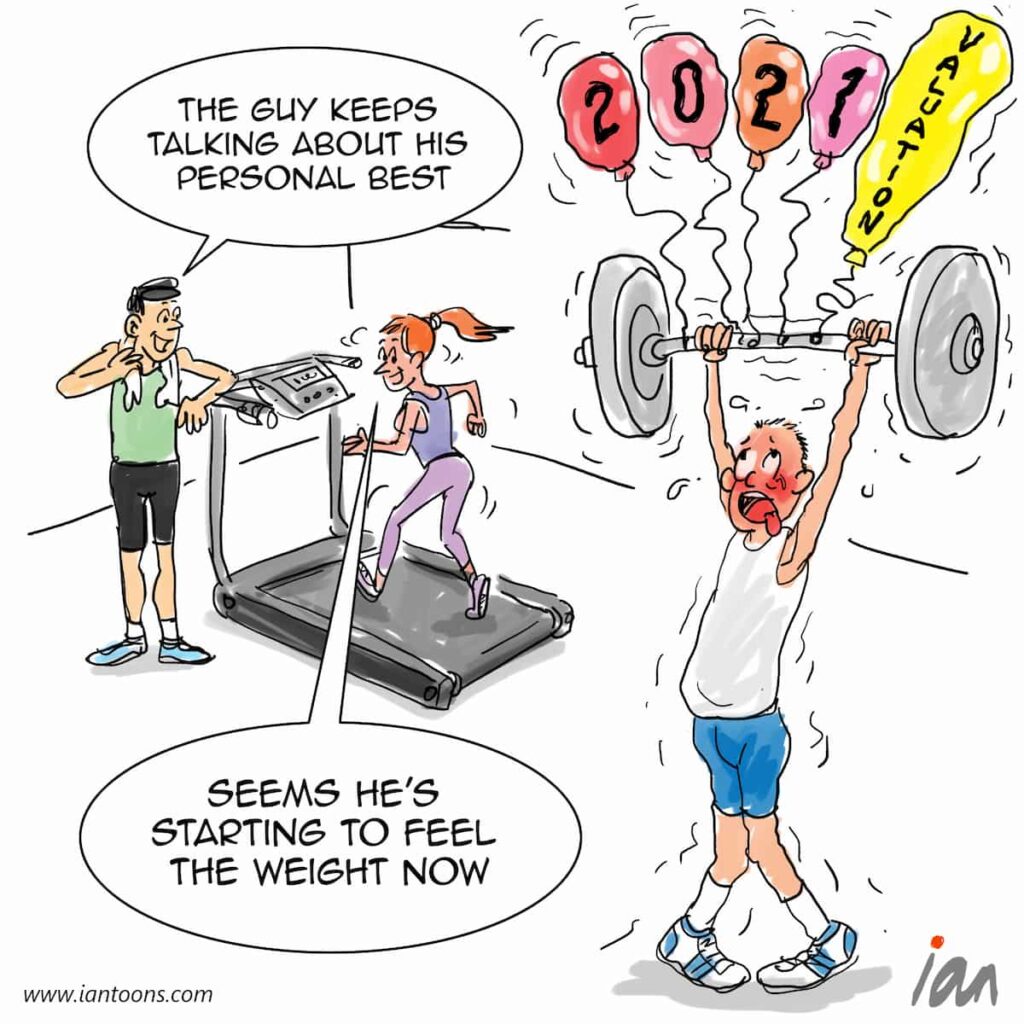

Feeling the Weight

“Feeling the Weight” – a cartoon that illustrates the cohort of startups that enjoyed high valuations in the last bull cycle are now finding it hard to get acquired.

With the second year of decline in IPOs from 2021 highs, most startups are dependent on a merger or acquisition for an exit.

However, data from Dealogic shows that Venture-backed startups saw a 19% drop in the number of M&A transactions.

One of the main reasons for these continued declines is that seller expectations remain stubbornly high.

The boards of startups are reluctant to accept that they are not going to grow into the sky-high valuations of 2021.

This is despite the precipitous drop in valuation of vested employee stock in the secondary market.

“What we’ve heard from some investors [is] that buying private secondaries in 2023 is like buying real estate in 2009,” said Tom Callahan, CEO of Nasdaq Private Market, a secondary trading marketplace.

It seems that startups boards need to go through the five stages of grief before their valuations can get to a realistic expectation for potential buyers.

11

0

0