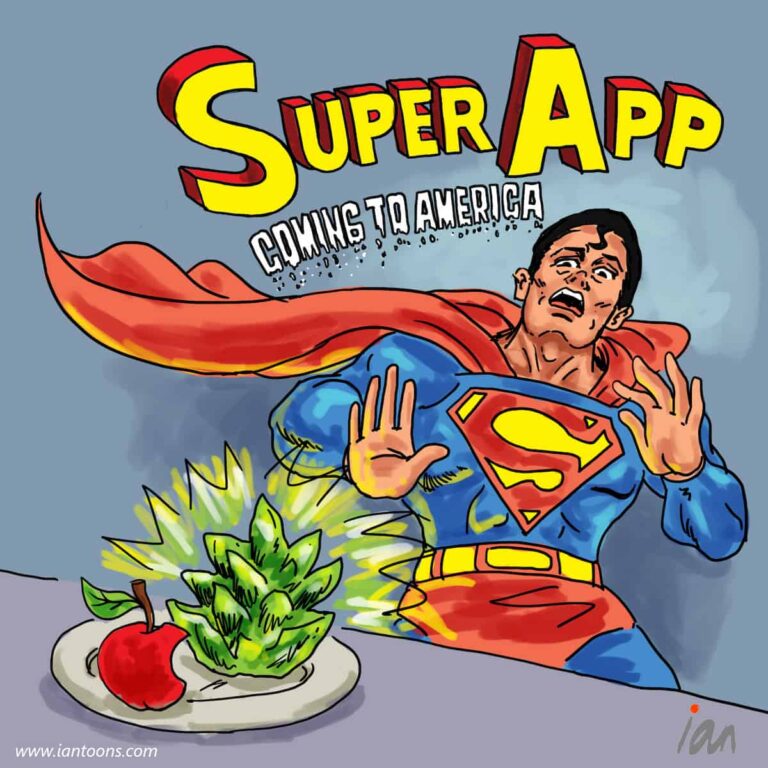

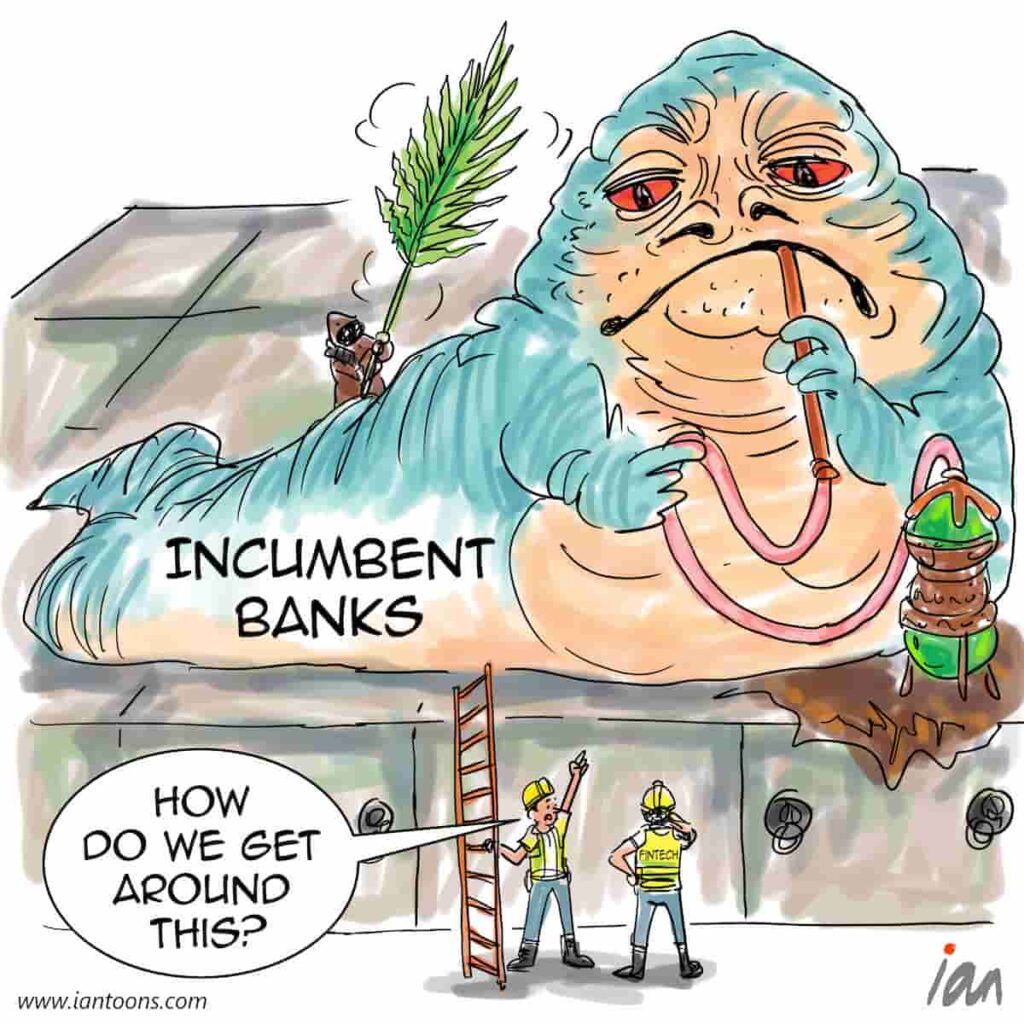

Incumbency Advantage

“Incumbency Advantage” – a cartoon that illustrates the dominating position of incumbents in the financial services industry that inhibits new entrants from taking market share.

Despite pouring $466BN globally into the Fintech market since 2014, there is only one Fintech (Shopify that was formed in 2006) that has a market cap over $100BN.

The incumbents, such as Visa, JP Morgan and MasterCard, just sit at the top of the market getting ever larger, for example Visa has $8BN – $10BN annual growth, which is the size of a good fintech like Sofi or Affirm.

Despite the promises of paradigm shifts and killing off dinosaurs, the fintech market is only $250BN in size … or less than 1% of the $28TN global financial services market.

Some of the reasons are in plain sight, including customer inertia, concerns around trust and the heavily regulated nature of the industry.

One additional consideration is that all fintech companies reinforce the current system, the one exception is DeFI, but this is even more stymied by regulation and trust issues at the moment.

With these structural moats, perhaps the best chance for the next $100BN Fintech company is one of the payment companies growing into new revenue streams, such as Stripe or Adyen.

16

2

0