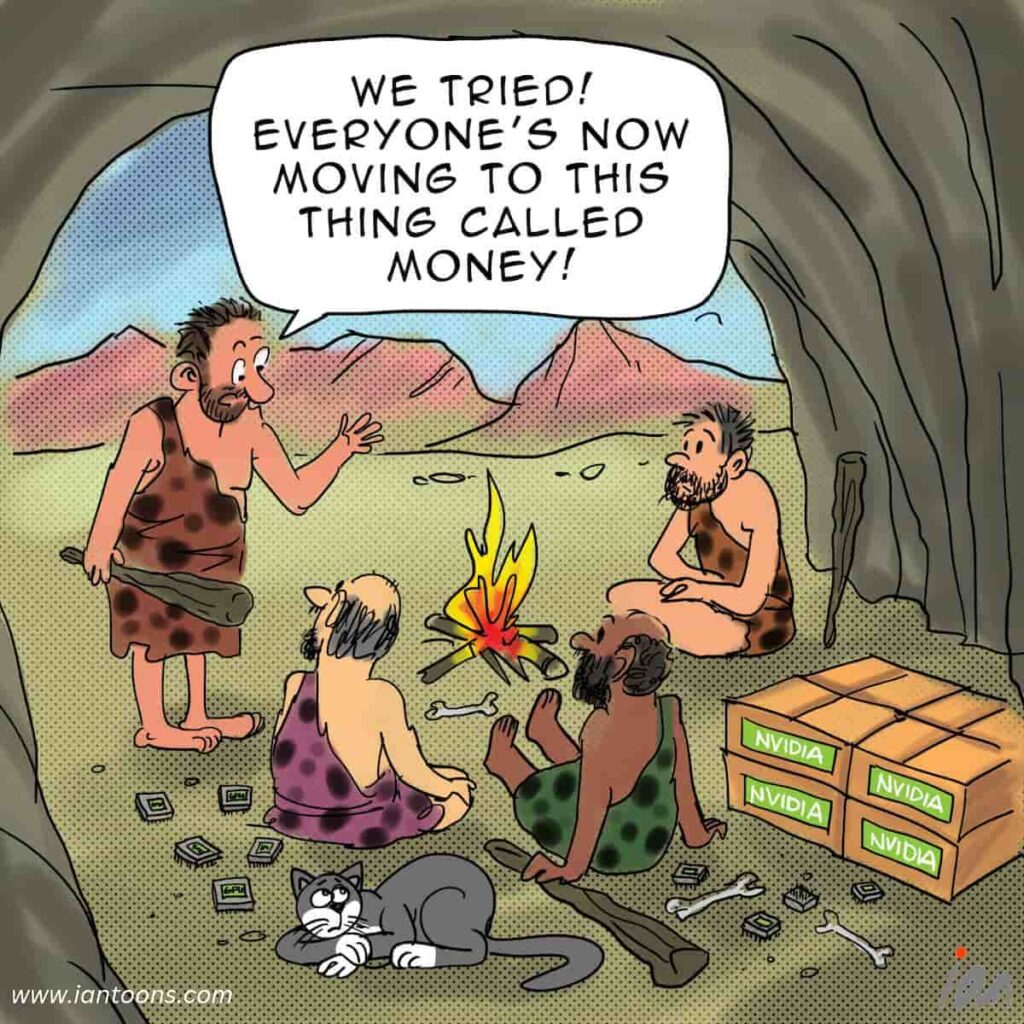

Barter

“Barter” – A cartoon that illustrates how NVIDIA chips have become a kind of money. In today’s AI boom, GPUs are the new gold bars, they are scarce, powerful, and traded by companies.

NVIDIA’s recent agreement with OpenAI proves the point. The company will supply up to 10 gigawatts of GPU capacity to power OpenAI’s next wave of data centers, backed by an investment worth around $100 billion. Much of that capital cycles back to NVIDIA as OpenAI fills those centers with its own hardware. It’s a closed loop, like a gold miner funding a mint that only uses his own bullion.

As Ejaaz Ahamadeen noted on The Limitless Podcast, “No one else makes GPUs as good as they do… this wasn’t a traditional, like, we’re investing in you, we’re getting an equity swap. It uses GPUs as collateral.”

Other deals follow similar logic. In Elon Musk’s xAI raise, NVIDIA reportedly invested $2 billion through a special-purpose vehicle (SPV) combining $12.5 billion in debt and $7.5 billion in equity. The SPV used that money to buy NVIDIA GPUs and lease them to xAI, with the chips themselves serving as collateral. Similarly, Lambda borrowed $500 million against its NVIDIA inventory. Mistral, Inflection, Figure, and others have taken NVIDIA investment tied directly to hardware purchases.

What’s emerging is an economy where compute power is capital. However, this does have a familiar ring to it. For example, oil in the 1970s or mortgages in the 2000s, both times where an industry turned its raw material into money. Each of these booms felt unstoppable until either scarcity or leverage catches up. In this case, ‘catch-up’ could mean competition from China, which is pouring billions into domestic GPU manufacturing to escape reliance on U.S. chips, while AMD’s MI300 series is gaining ground in data centers. Either could break NVIDIA’s monopoly if they match its performance or supply scale … or the AI music stops altogether and we go back to money.

40

5

1

Sources:

Jeremy Kahn (Sep 28, 2025) – Nvidia’s $100 billion OpenAI investment raises eyebrows and a key question: How much of the AI boom is just Nvidia’s cash being recycled? – Fortune

Charles Martinez (May 06, 2025) – How To Make Money With Nvidia GPUs in 2025 (For Beginners) – Dicloack

Elongated_musk (May 14, 2025) – GPUs as Collateral — Chip Based ABS – Medium