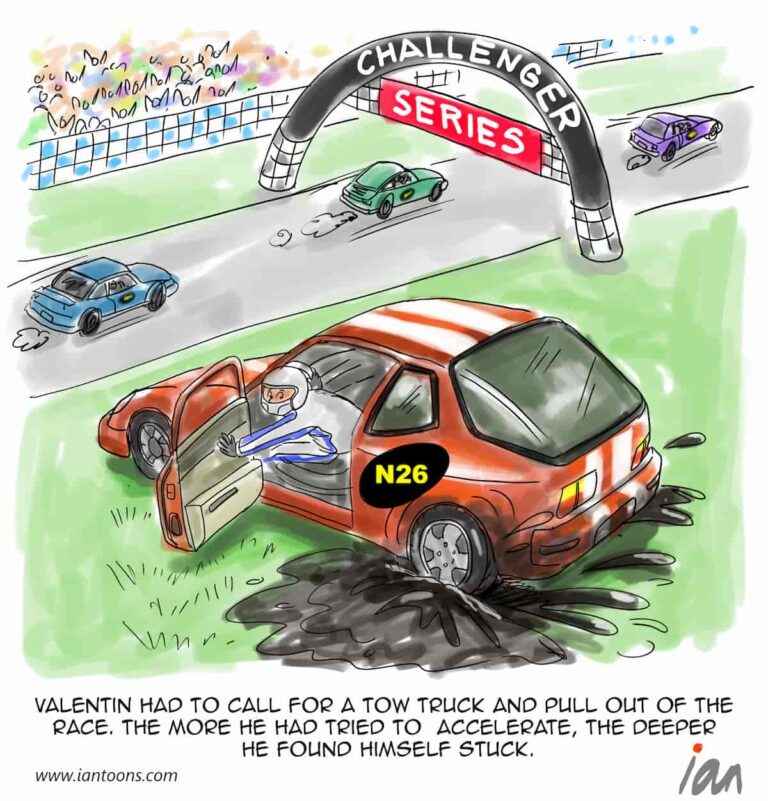

Challenged

“Challenged” – a cartoon that illustrates the problem challenger banks are having to break into the traditional banking system.

Fintech challenger banks have been on a wild ride from pioneers in 2010 building “mobile only accounts” to CashApp, Stripe and “every company will be a Fintech company.”

As recently as 2021 VC investment in the sector peaked at an impressive $14BN, but this plunged to $4.3BN in 2022 and the sector is currently reeling from the macro-environment and failure to penetrate the market.

FinTech’s in the US focused on offering better core banking services targeting new customers; however, market penetration is still relatively low (e.g. Chime, the largest challenger bank in the US, has 13M customers, which would make it a top 20 bank by number of accounts, but the number of deposits make it similar in size to a small regional bank).

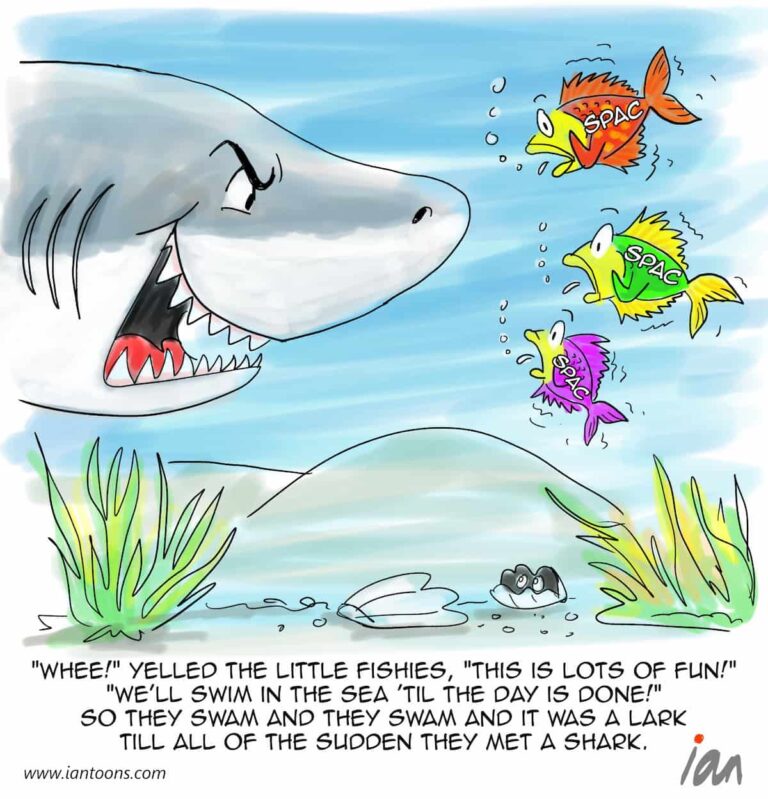

One of the issues is that most of the challenger banks make money through interchange charges from core banking services (e.g. debit or credit cards), yet the banking industry has higher profitability and return on equity from fee-based businesses (e.g. payments, asset management or investment banking).

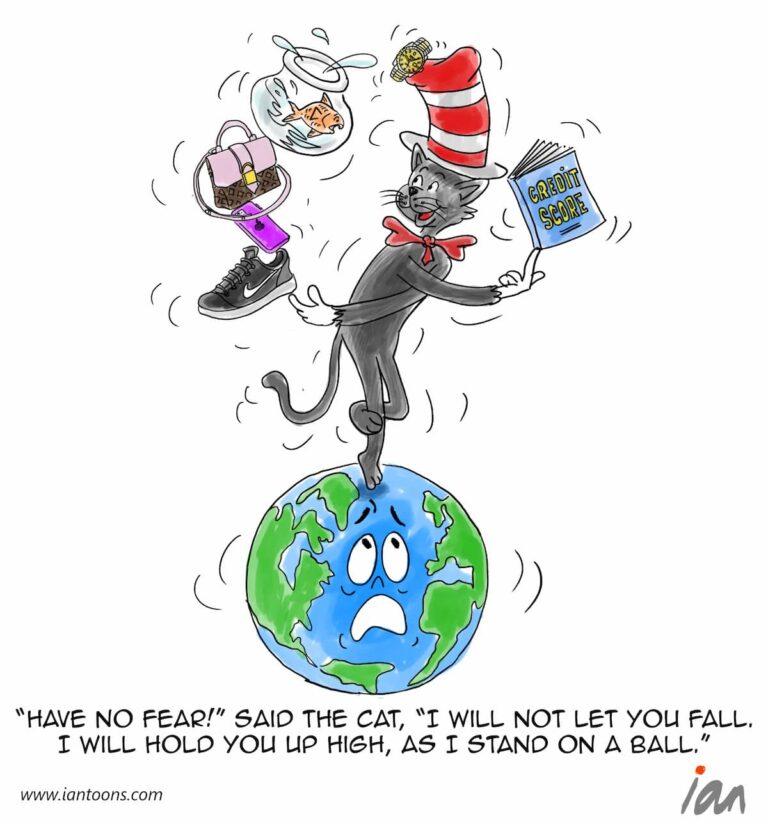

One potential new entrant that could address the scale issue and be well placed to pursue payments is Twitter/X, which is Elon’s plan to turn Twitter into a SuperApp with 450M users – though this company comes burdened with considerable brand and trust issues.

21

2

1