Double Dipping

“Double dip” – A new cartoon that illustrates how senior tech leaders have helped turn broken norms into standard practice.

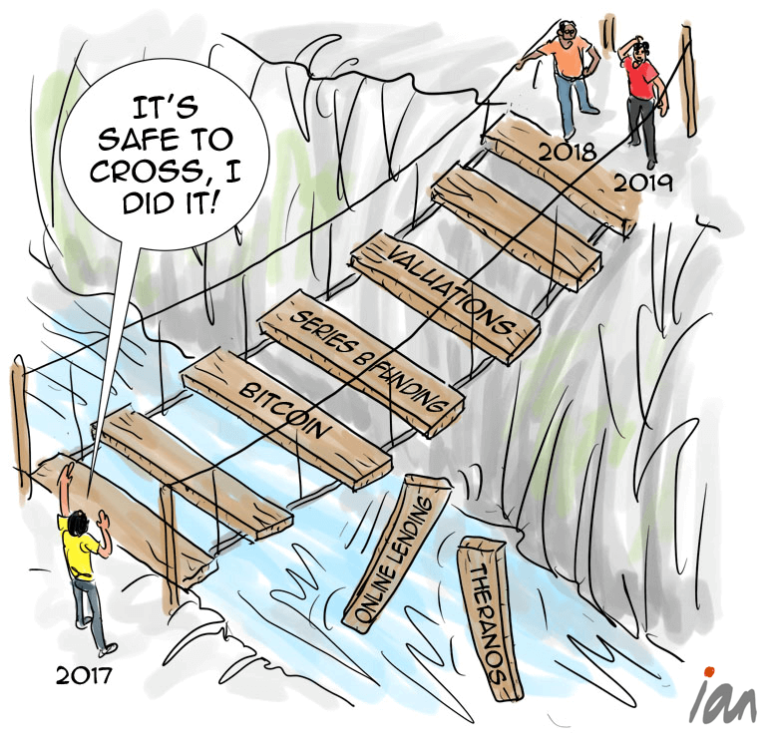

Conflicts of interest used to be treated as a hard stop because companies had already paid the price for ignoring them. Enron collapsed after executives ran off-balance-sheet entities they personally controlled. WeWork nearly destroyed itself when Adam Neumann leased buildings he owned back to his own company.

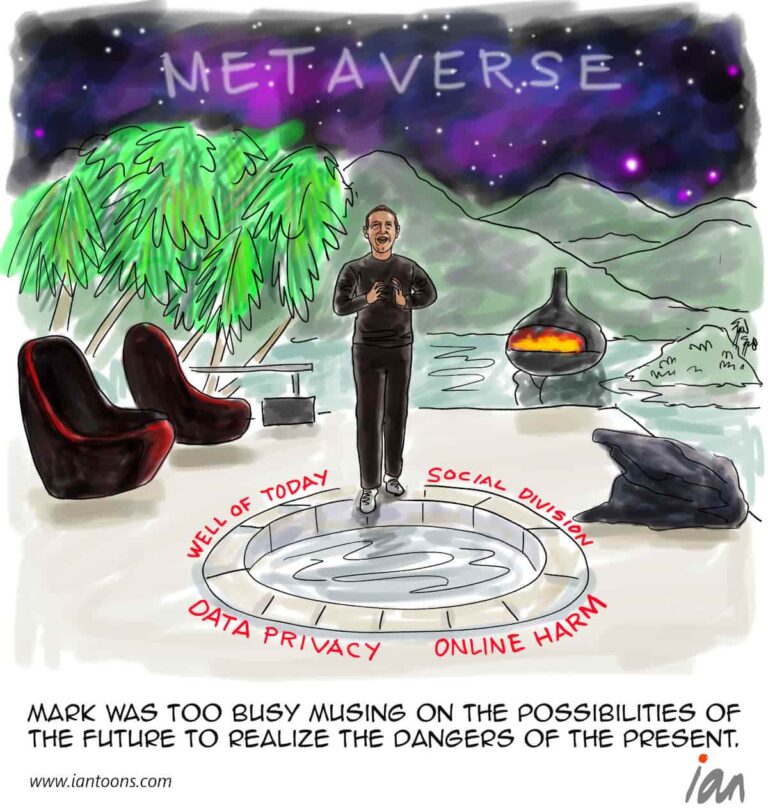

What’s changed is that this behavior is no longer disqualifying. In today’s tech culture, founders accumulate power faster than boards can contain it, and “managing” conflicts has replaced avoiding them. The assumption now is that the leader is too important to constrain, so the organization absorbs the risk instead.

Public information on OpenAI’s dramas show this. When the board briefly fired Sam Altman in November 2023, it wasn’t over performance or vision, it was governance. One of the formal reasons cited was that he was “not consistently candid in his communications.” While still CEO of OpenAI, Altman was raising billions for a separate AI chip venture, internally codenamed Tigris, intended to build an alternative compute supply chain.

Also, in a 2017 internal memo later revealed in court filings, OpenAI president Greg Brockman wrote: “We cannot say that we’re committed to the non-profit and then, three months later, do a for-profit structure. That would be a lie.”

The pattern isn’t limited to tech. Donald Trump has blurred public office, family business and now crypto ventures into one continuous conflict hustle. Outrage barely lasts a news cycle anymore.

But, when everyone assumes everyone has an agenda, trust stops being expected. And the irony is that some of the people promising new systems of trust (eg. WorldCoin) are also undermining it.