Embedded

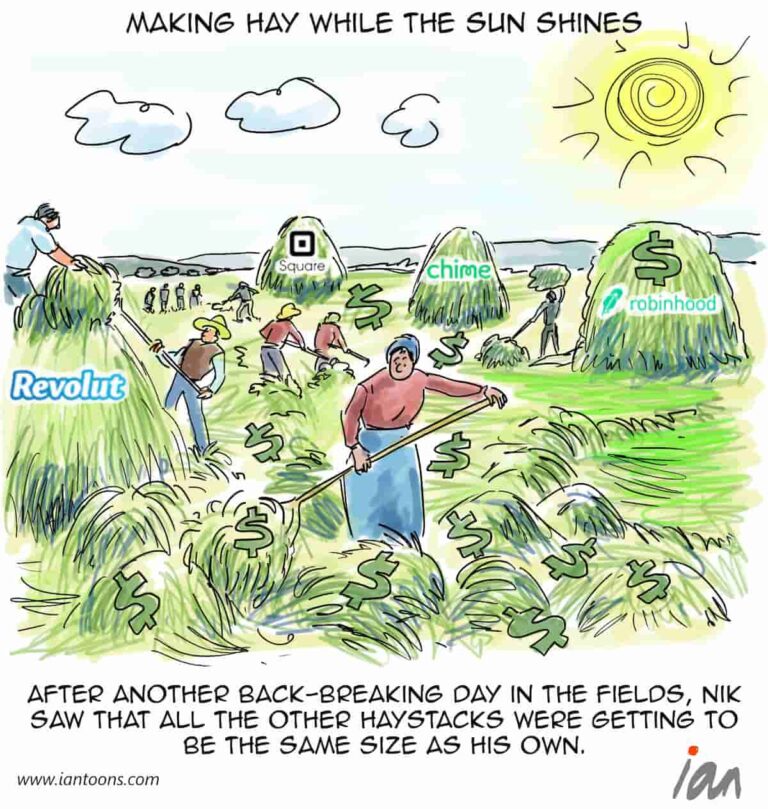

“Embedded” – a cartoon that illustrates the opportunity for bringing financial products closer to the point of service for consumers.

Many of us have forgotten the pain of paying a surly taxi driver at the end of journey… the demand by the taxi driver for cash-only, our credit card not working or navigating the tipping process, which the Uber app removed by allowing payment to be automated.

This is the concept of embedded Fintech, integrating fintech solutions into third party websites, apps, or other business processes.

According to CapitalIQ, this market is projected to be $320Bn by 2030 and we are just at the beginning of Buy Now Pay Later (BNPL), vertical SMB payments, lending, and B2B platforms embedding finance.

A couple of examples include Driven, which embeds BNPL into the payment of traffic fines. Users can apply to Driven by connecting their bank account to pay traffic or parking fees in four equal installments.

Secondly, Marley works with wedding venues to help them offer BNPL to couples. The pitch helps the wedding venues to win more bookings, get larger deals, and get paid faster.

The challenge with this is regulation and transparency, in the words of Brett King, a futurist and author remarked, “consumers are interacting with a service but often don’t realize the financial infrastructure behind it. That creates both regulatory challenges and risks around transparency and consumer protection.“

But, some of these hurdles are being addressed with new FinTech’s starting up Compliance as a Service offerings, for example, Feedzai, which uses historical and behavioral analysis of data to identify whether a transaction is potentially suspicious or not.

19

–

3

Sources:

Meaghan Johnson (May 23, 2024) – The Great Balancing Act: The Future Of Embedded Finance – Forbes

Andy Dresner, Brian Pike, and Harry Schiff (Apr 11, 2024) – Embedded finance: The choices and trade-offs for US banks – McKinsey

Louis Thompsett (May 1, 2024) – Embedded Finance: Transforming Financial Services – FinTech Magazine