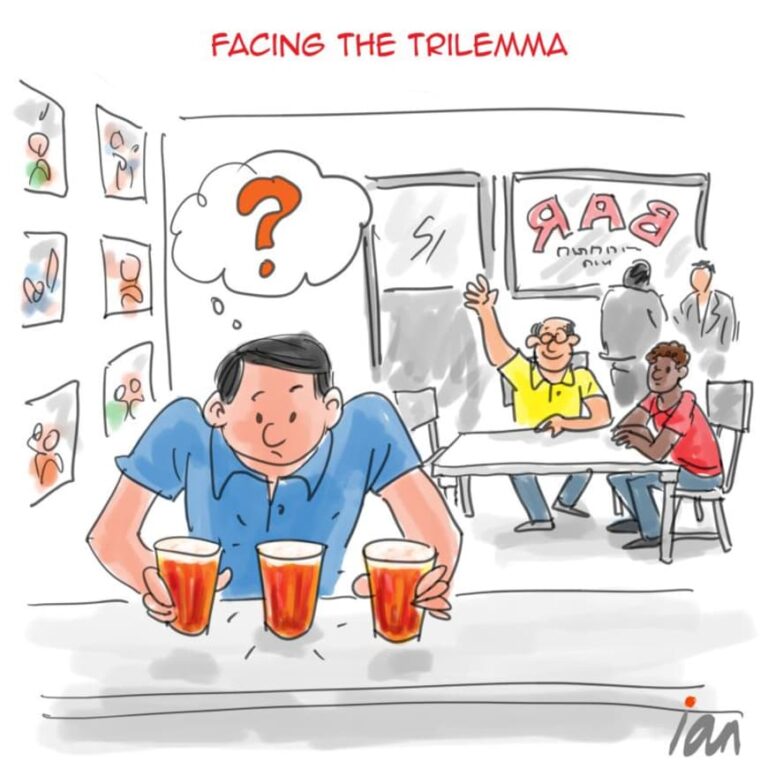

First Temptation

“First Temptation” – a cartoon that illustrates how natural temptation will bring in the next wave of retail crypto buyers.

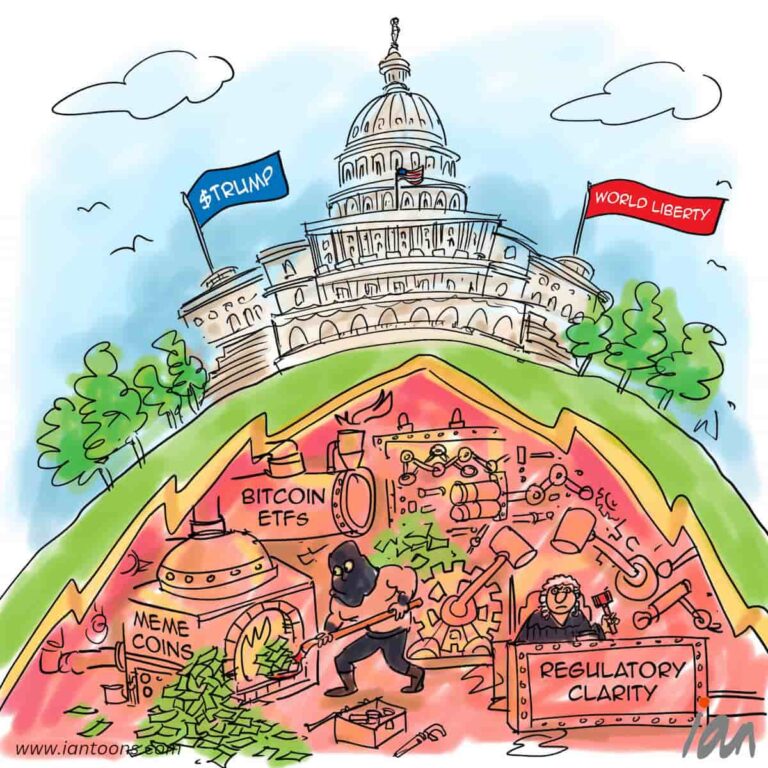

BlackRock, one of the largest global fund managers, was one of the first to launch a Bitcoin ETF, which broke records by reaching $10 billion faster than any ETF in history.

Building on this, Blackrock recently announced the launch of its ‘BUIDL’ fund week, a tokenized treasury fund on chain further merges traditional and crypto/digital finance by issuing dividends to investors’ wallets monthly.

According to Blackrock’s Head of Digital Assets, Robert Mitchnick, “the crypto community would like to see a long tail of other crypto products from BlackRock, but that’s just not where we’re focused”.

However, once retail consumers start to get familiar with crypto through Bitcoin, it is human nature that some will start to try other crypto assets that offer even higher yields.

As consumers make returns beyond their principal, the temptation is to chase higher yields, initially starting off with yield farming that can offer 5%-15%, Layer 1 or 2 coins that have seen triple digit gains in the last couple of months (e.g. Arweave at 178%) and then meme coins that have seen over a thousand percent increase in market cap (e.g. Book of Meme at 1,385%).

As Warren Buffett said, ““People start being interested in something because it’s going up, not because they understand it or anything else.

But the guy next door, who they know is dumber than they are, is getting rich and they aren’t. And their spouse is saying can’t you figure it out too?”

8

0

1