Frontier Investing

“Frontier Investing” – a cartoon that illustrates how the venture capital industry is evolving.

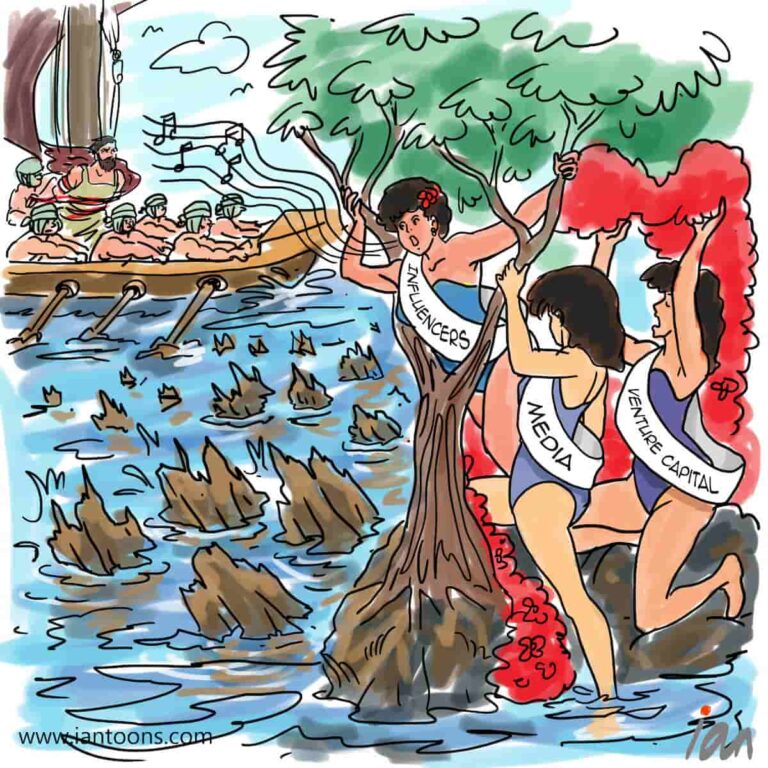

The venture capital industry was for a long-time a cottage industry, where many investors would not want to travel outside a day’s drive of Sand Hill Road in Silicon Valley.

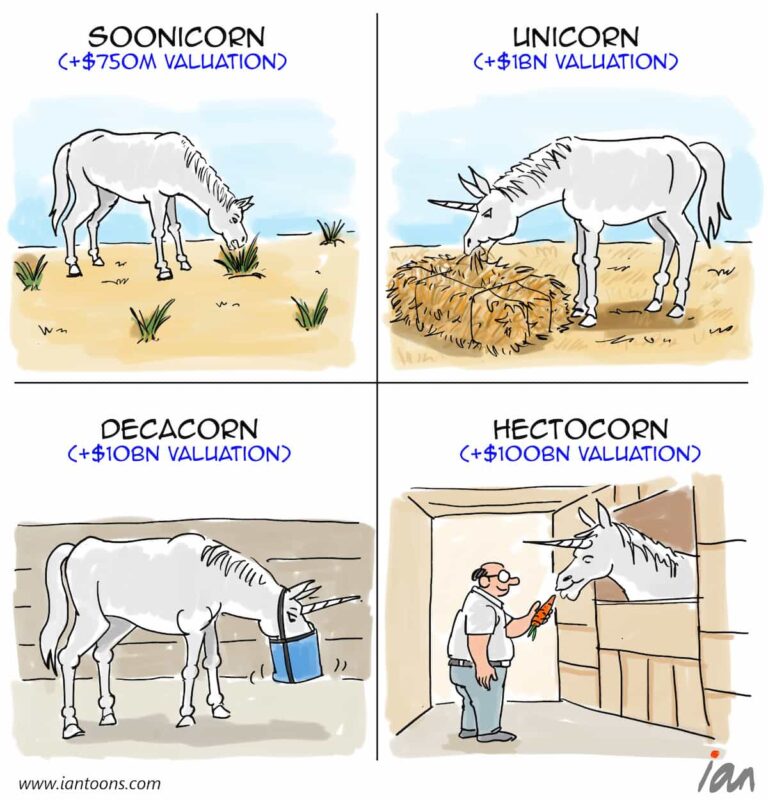

While the industry expanded from <500 VCs in the mid-1990s to 2,500 today, many of the top investors still believe that the industry is more art than science.

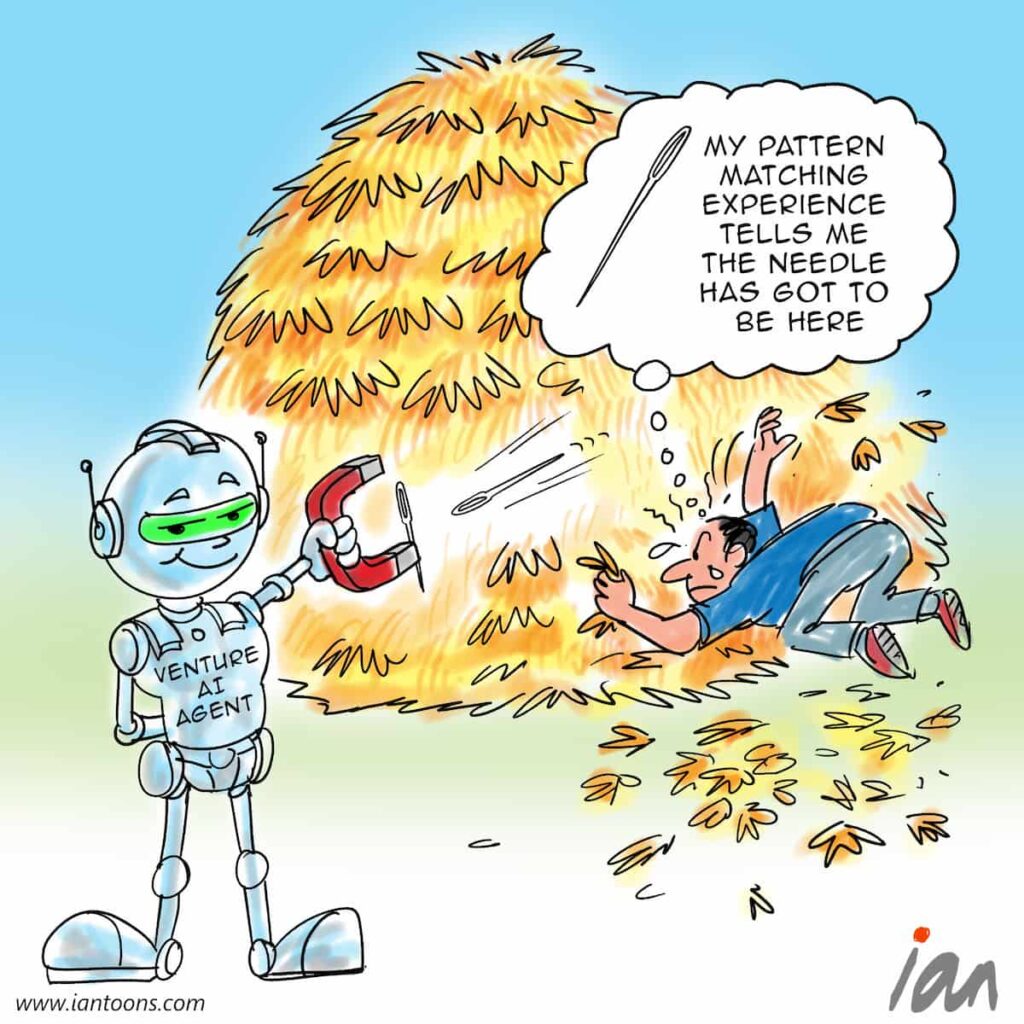

In an interview with The Atlantic, Mike Moritz of Sequoia Capital said, “This business is more about art than science. You rely on pattern recognition, you rely on your wits, and you rely on your ability to spot talent.”

Further illustrating this, a Harvard Business School working paper by Paul Gompers investigated how VCs’ personal networks and prior successes influenced their deal sourcing and investment choices.

Their findings indicated that many investors leaned on pattern matching, looking for characteristics and backgrounds they had seen in successful startups before.

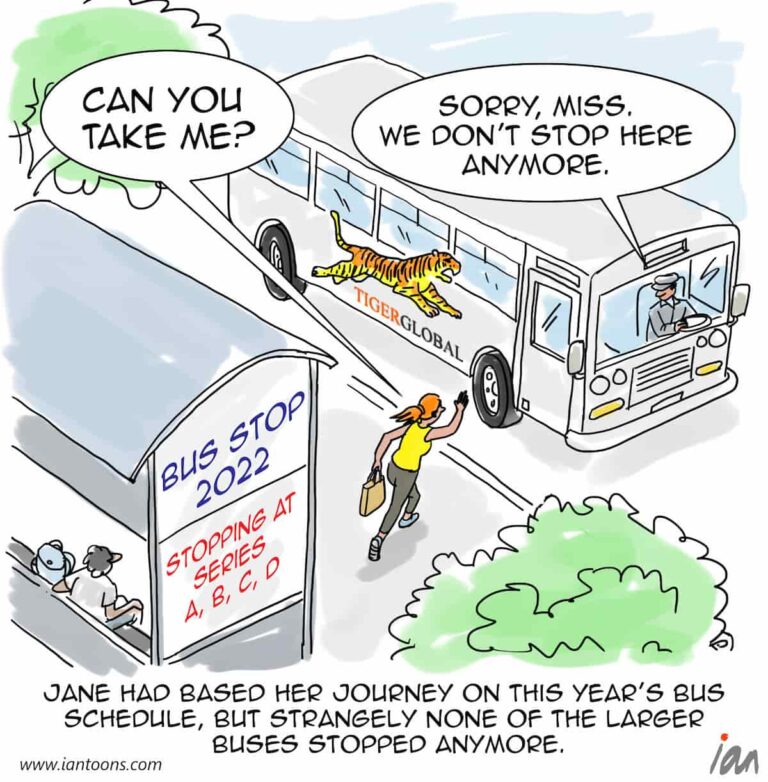

By the late 2010s, a new type of venture firm started appearing, those that used data from the likes of Pitchbook, Github and LinkedIn to better sift through large data sets of early stage startups for patterns.

Firms like SignalFire and Correlation Ventures, raised mid-sized funds and saw successful exits (e.g. SignalFire’s investment in Frame.io sold to Adobe for $1.27BN).

Now the wheel is turning again. With advances in AI and the success of meme tokens, AI agents have been created that act autonomously of human interaction to make investment decisions in early stage projects.

For example, ai16z, an organization autonomously managed by an AI agent known as “Marc AIndreessen” that has a market cap of $2BN, is now attracting other AI agent projects to its startup launchpad. Projects built on ai16z’s framework use its token and in return ai16z burns its token to increase the value of the available supply.

Whether these AI Agent projects built on ai16z can beat the returns of the top 5% of venture funds remains to be seen, but it probably puts the remaining human fund managers in an uncomfortable position to keep justifying their management fees.

23

2

2

Sources:

Melia Russell and Samantha Stokes (Jan 9, 2025) – Silicon Valley is licking their chops at the promise of AI ‘agents.’ These are the startups to watch. – Business Insider

Tiernan Ray (Sep 30, 2024) – The journey to fully autonomous AI agents and the venture capitalists funding them – ZDNET

Tick J. (Nov 19, 2024) – The Age of AI Agents: Redefining Venture Capital and Startups – Medium