Home

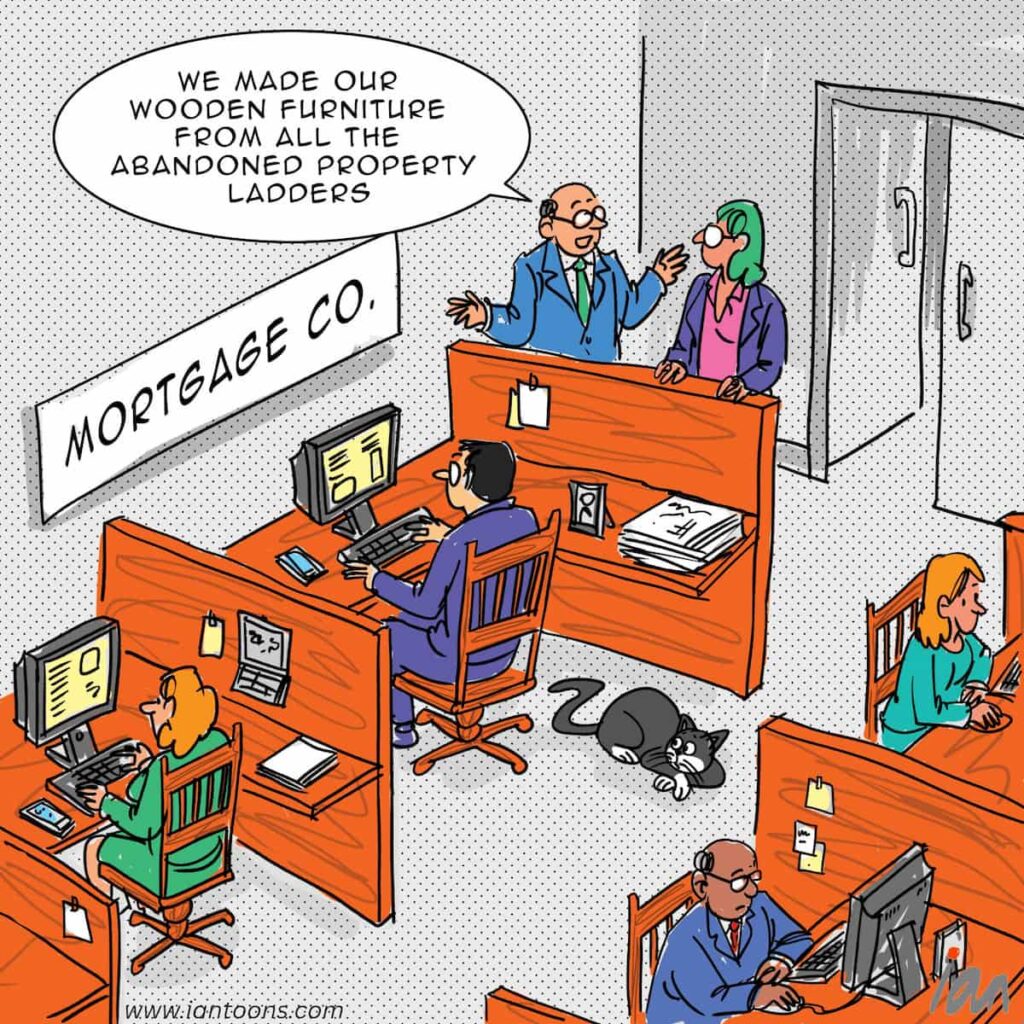

“Home” – a cartoon that illustrates how new financial products might be able to solve the home-affordability challenge for the next generation of buyers.

A home has always been more than four walls. It’s been the engine of wealth-building in America, the asset that lets families build equity, tap HELOCs to fund education or small businesses and eventually downsize into retirement. For decades, ownership rates hovered near 70%, and that stability made the American dream feel predictable.

But, that system cracked for younger generations. Adjusted for income, housing prices are now 40% higher than in the 1970s, and the median home in major cities costs 6x the median salary. Consequently, Millennials hit historically low homeownership rates, stayed renters far longer, delayed marriage and in many cases moved back in with parents. The rent economy became a holding pattern rather than a stepping-stone.

At the sametime, the mortgage industry didn’t evolve with society. It continued to prioritize full-time W-2 workers with long credit histories, leaving freelancers, immigrants, and part-time professionals trapped in a byzantine process that still takes 45 days and offers little transparency.

Fintech is finally starting to attack the problem. Credit scoring companies (e.g. Credit Sesame) are working with banks to treat on-time rent payments as legitimate credit signals. Blockchain tokenization is enabling shared homeownership and fractional down payments.

Companies like Tidalwave, which just raised $22 million, are rebuilding the mortgage process itself. Co-founder Diane Yu recalls her first mortgage as “terrifying,” a black box of documents and silence. Tidalwave integrates with Fannie Mae and Freddie Mac, automates document evaluation, and gives borrowers multilingual, real-time clarity. Their goal is to take the process from a 45-day wait to a week, which is the type of speed digitalization was meant to unlock.

None of this fixes interest rates or housing supply. But for the first time in decades, the tools around homeownership are being redesigned to help get the next generation on the property ladder.

16

1

1

Sources:

Jeff Kauflin (Nov 19, 2025) – Fintech Wealthfront To Offer Lower-Rate Home Mortgages – Forbes

Allie Garfinkle (Nov 21, 2025) – Tidalwave raises $22 million Series A to improve the mortgage process with AI – Yahoo Finance