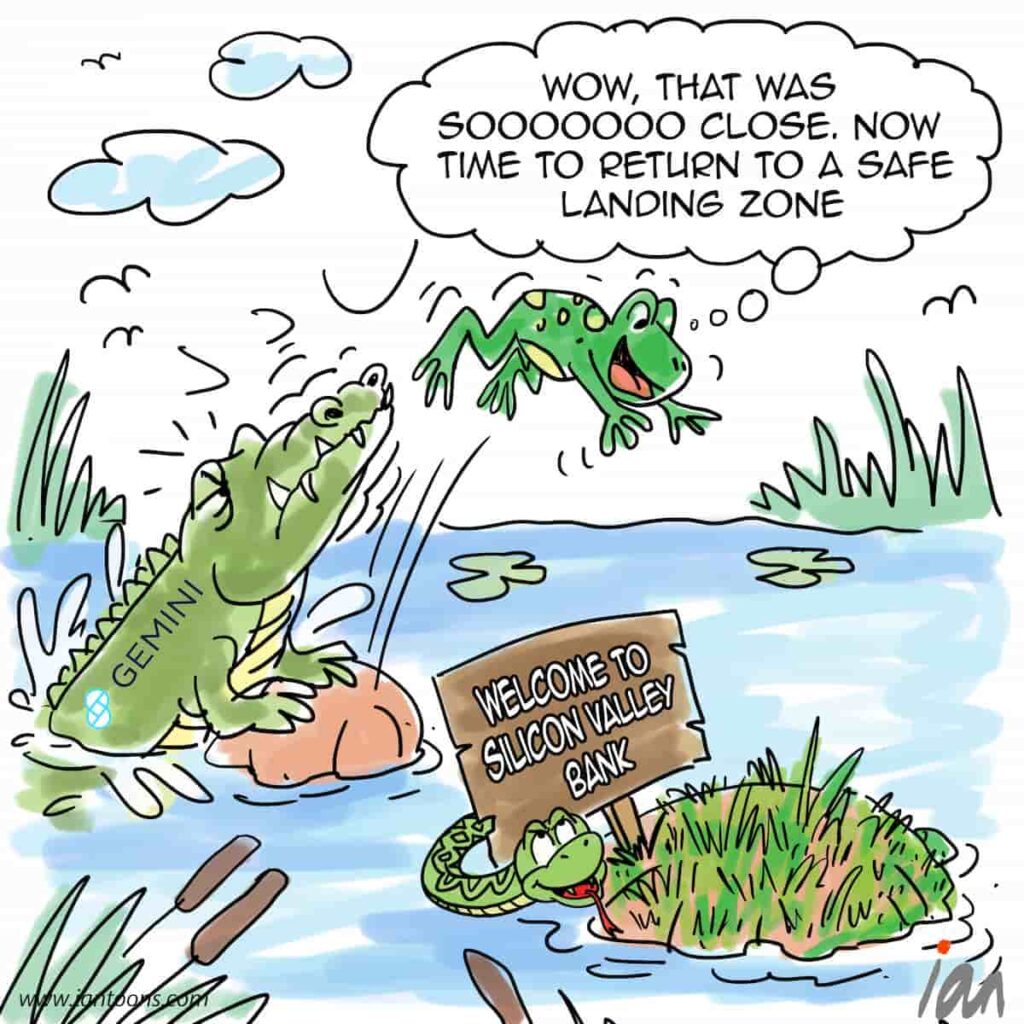

Hopping Mad

“Hopping Mad” – a cartoon that illustrates the lack of asset security.

The last six months have seen crypto investment products stop redemptions (e.g. Gemini Earn), crypto exchanges shut-down and freeze assets (e.g. FTX) and now a bank-run in TradFi companies (Silicon Valley Bank and Signature Bank).

While FTX had $5BN of assets that are now frozen and in the hands of administrators that will take years to access, SVB had over $200BN in assets when it went into receivership.

Although account holders can get $250K back in the US through the FDIC program, it is estimated that 97% of SVBs accounts were businesses that exceeded the FDIC program.

What is somewhat strange is that no FinTech entrepreneur has thought to create an app for consumers or small/medium businesses that balances accounts to stay below the $250K threshold or at least alert customers when they exceed this.

From cursory research, the closest apps to this are budget balancing apps like Intuit’s Mint.

In the meantime, the human cost of all these failures reverberates into people’s lives, whether it’s savings wiped out to buy a home or a startup missing payroll.

14

2

0