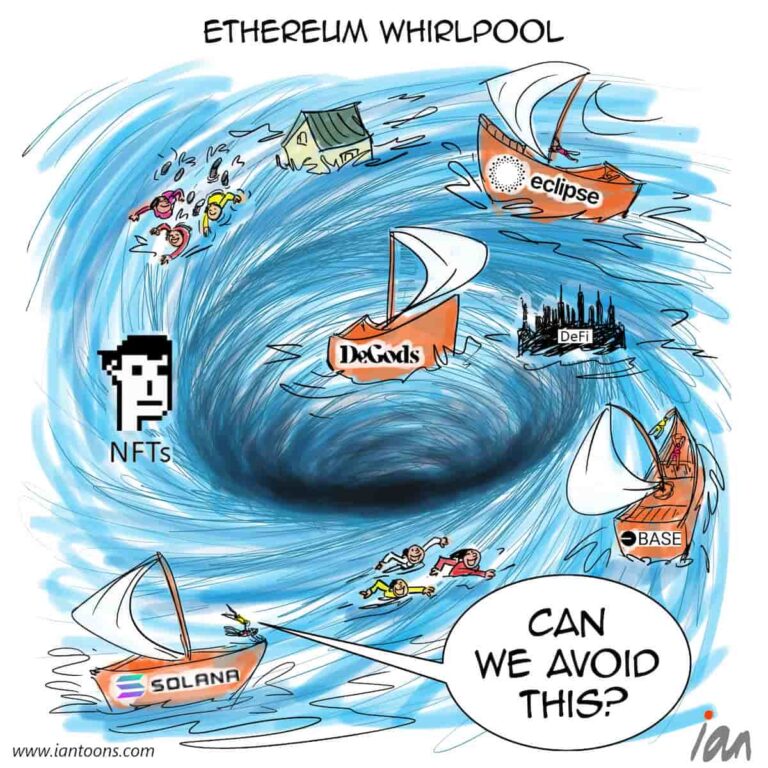

Impossible Challenge

“Impossible Challenge” – a cartoon that illustrates that the latest crypto bull market is over and with it the concept of four year cycles.

For more than a decade, crypto moved to a predictable rhythm. Bitcoin’s halving set the tempo for four-year waves of building, exuberance and sharp crashes. Even with the chaos, each cycle expanded the ecosystem. After 2018, Ethereum’s developer base grew. After 2021, the industry emerged with stronger L2s, better security tooling, and far more robust stablecoin rails. The pattern drew in new talent and capital, and the sector kept compounding.

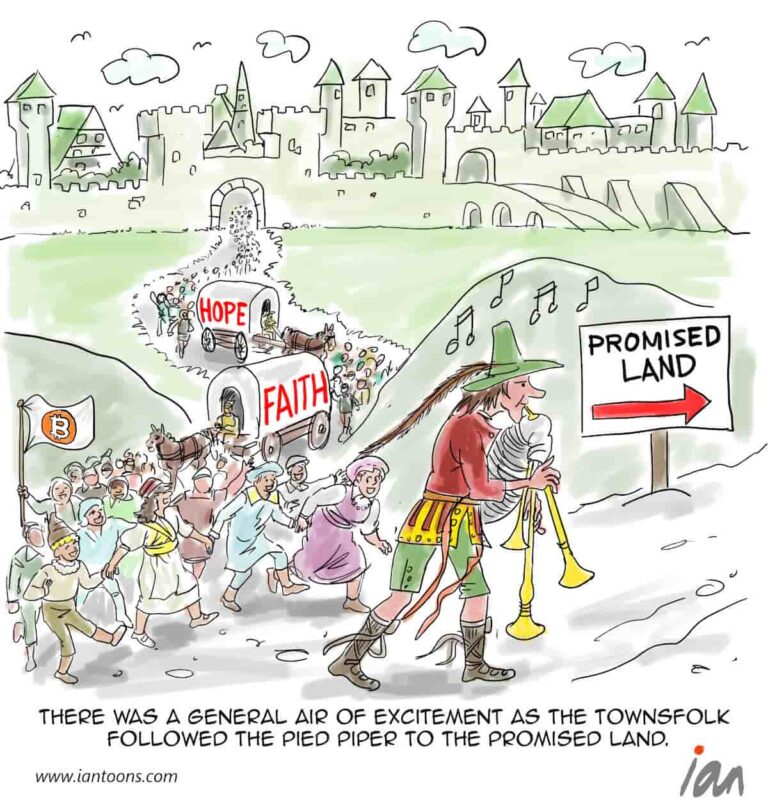

Earlier bull markets also lifted everything. In 2017 and 2021, liquidity was indiscriminate. If a token existed, it went up and many projects with questionable value benefited from this “rising tide” concept.

This current cycle looks nothing like that. Bitcoin now controls roughly 60% of total crypto value, while most altcoins have posted double-digit weekly drops. Momentum has narrowed into memes, RWAs, and prediction markets. Even this week’s heavy sell-off and $19 billion in liquidations didn’t trigger fears of a systemic 3AC-style implosion. Investors are behaving like participants in a maturing asset class, not passengers on a fixed halving script.

Crypto is starting to do the same. As Raoul Pal, founder at research company Real Vision, put it earlier this year, “the idea of a predictable four-year crypto cycle is fading. The bull market isn’t a calendar event anymore, and anyone waiting for one is looking in the wrong place.”

38

11

1

Sources:

Nina Bambysheva (Nov 11, 2025) – “The Days Of Bitcoin’s 100x And 1000x Are Over” – Forbes

Carlos Garcia and Ben Weiss (Oct 31, 2025) – Crypto’s big ‘Uptober’ ends with a whimper, Bitcoin down 4% – Fortune

Economista Sincero (Nov 08, 2025) – Has the Bitcoin Cycle Come to an End? | What Could Happen to Cryptocurrency Prices in 2025? – YouTube