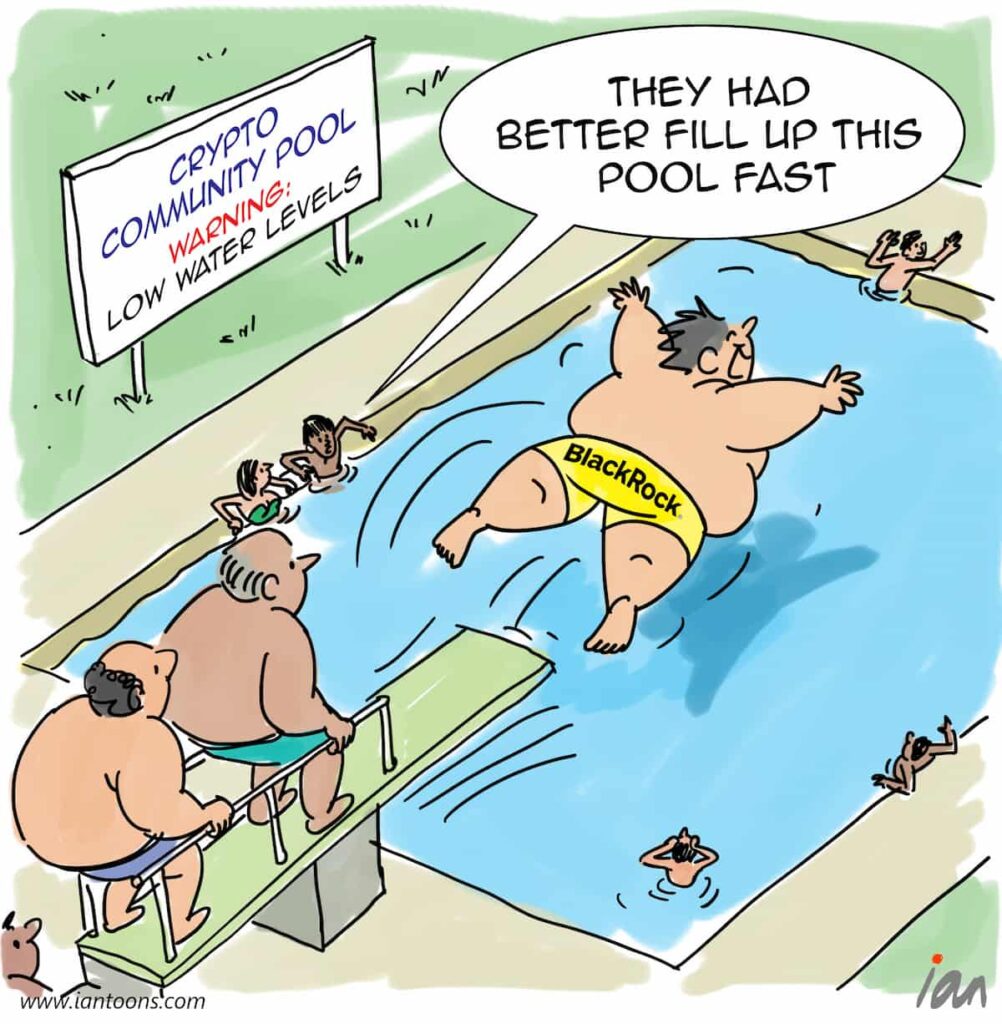

Making Waves

“Making Waves” – a cartoon that illustrates how the arrival of institutional investors into the crypto industry might have some unintended consequences.

The crypto markets began as a consumer investment opportunity, primarily driven by FOMO at each new bull market cycle.

But, everyone realized the big opportunity was to attract institutional capital to increase market liquidity, starting with Neobanks (e.g. Revolut) and spreading to traditional financial institutions (e.g. JP Morgan), companies (e.g. Tesla) and asset managers (e.g. Northern Trust).

Most recently, BlackRock, the world’s largest asset manager with $10Tn under management, made an agreement with Coinbase to allow clients direct access to crypto through Coinbase Prime.

However, with crypto markets dropping from $3Tn to $1Tn in the last 9 months, market liquidity is drying up just as some of the big whales are starting to enter.

This could have the detrimental effect of making the markets unstable as fairly small trades by the larger institutional players could cause price gyrations and give the new entrants market maker advantage.

18

6

1