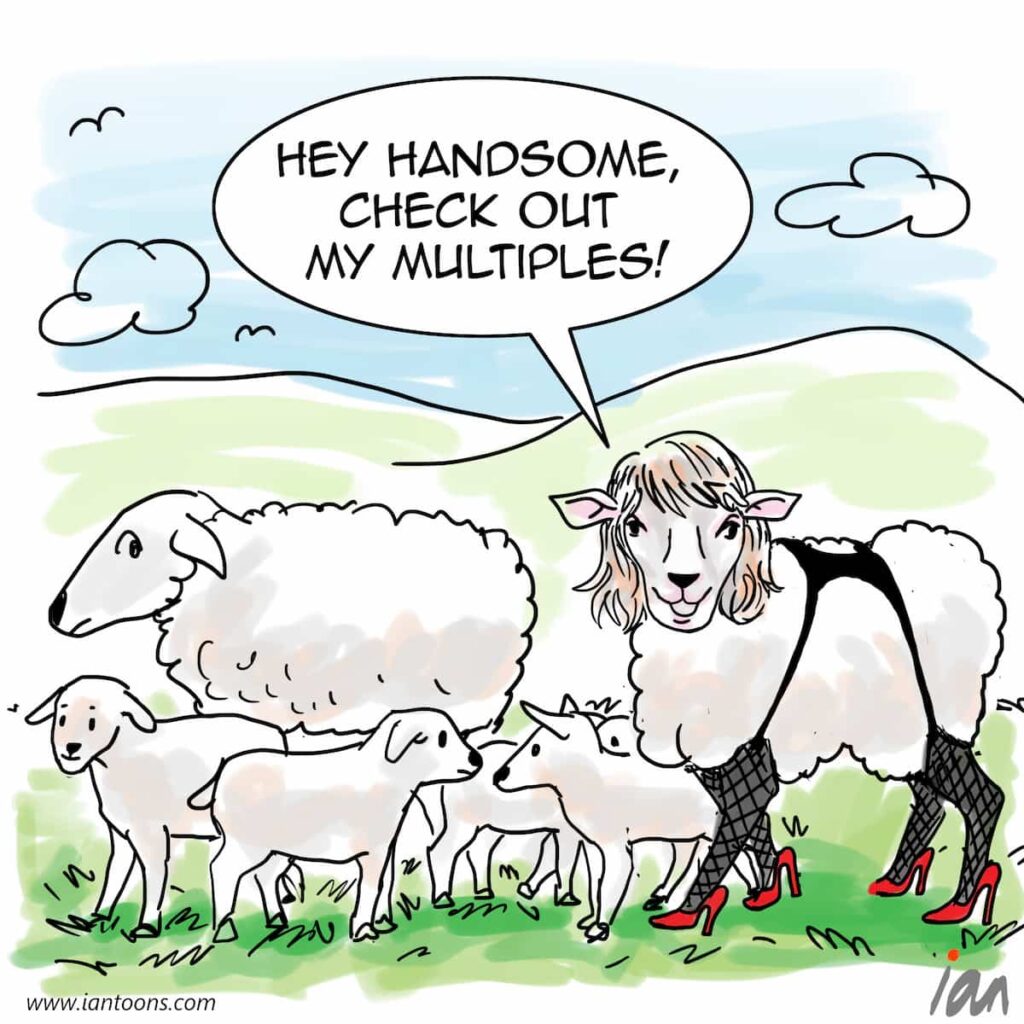

Mutton dressed as lamb

“Mutton dressed as lamb” – a cartoon that illustrates how latter stage Fintech’s are misjudging their valuation to the public markets.

After reaching a record $239 BN across 7,321 deals in 2021, total global fintech investment across M&A, PE, and VC fell to $164 BN across 6,006 deals in 2022.

Despite this, many fintech’s are still valuing themselves as software businesses with multiples of 6x-8x their annual revenue.

Their justification is that since they provide a subscription business, like enterprise software products, they can benefit from this higher multiple.

However, not all fintech sectors have characteristics of the predictable and scalable revenue model of enterprise SaaS.

For starters, there are significant regulatory and compliance hurdles that make fintech far more complex, and riding on top of another an institutional bank’s payment rails does not make a fintech startup as ‘only providing software.

As Ansaf Kareem of Lightspeed Ventures remarked, “if you pay $12/month to access a bank account primarily digitally, can you call yourself a SaaS company?”

To address this, fintech entrepreneurs would be advised to align their valuations to sector-based peers, not as a monolithic fintech sector and certainly not enterprise SaaS.

For example, payment companies typically trade at higher annual EBITDA multiples to insurtech firms, while lead generation companies (e.g. Credit Sesame, Nerd Wallet) are analyzed more on their conversion rate on affiliate leads (EV/ NTM Revenue ratios).

16

0

0