Numerate

“Numerate” – a cartoon that illustrates how the Venture Capital industry is moving towards a data driven approach to running their businesses and making investments.

Jim Brayer, formerly Managing Partner at Accel, remarked “valuation is both art and science.

The science is picking a price, and the art is knowing which 5% of the deals to invest in at any price.” Recently, science has started to help with the selection process too.

Most venture capitalists use pattern matching and their own experience to identify red flag signals to concentrate on the 1% of deals with the most promise, according to research by Stanford Professor Ilya Strebulaev in his book “Fast Lane.“

Venture firms, like SignalFire and EQT Ventures, have developed proprietary data platforms, which track millions of companies in real-time to assist in sourcing and screening investment opportunities.

For example, SignalFire’s platform discovered Frame.io, a video collaboration platform, prompting the fund to invest in its early funding rounds, and Frame.io was subsequently acquired by Adobe for $1.2BN. By the end of next year, data, analytics, and AI are expected to inform over 75% of VC deal analyses according to a report by Data-driven VC.

The same report noted that using AI and other LLM tools enables VC staff to work more effectively, increasing productivity by 40% and allowing funds to achieve more with fewer resources.

This provides more time for VCs to focus on their core two roles of finding new deals and supporting portfolio companies in the later stages.

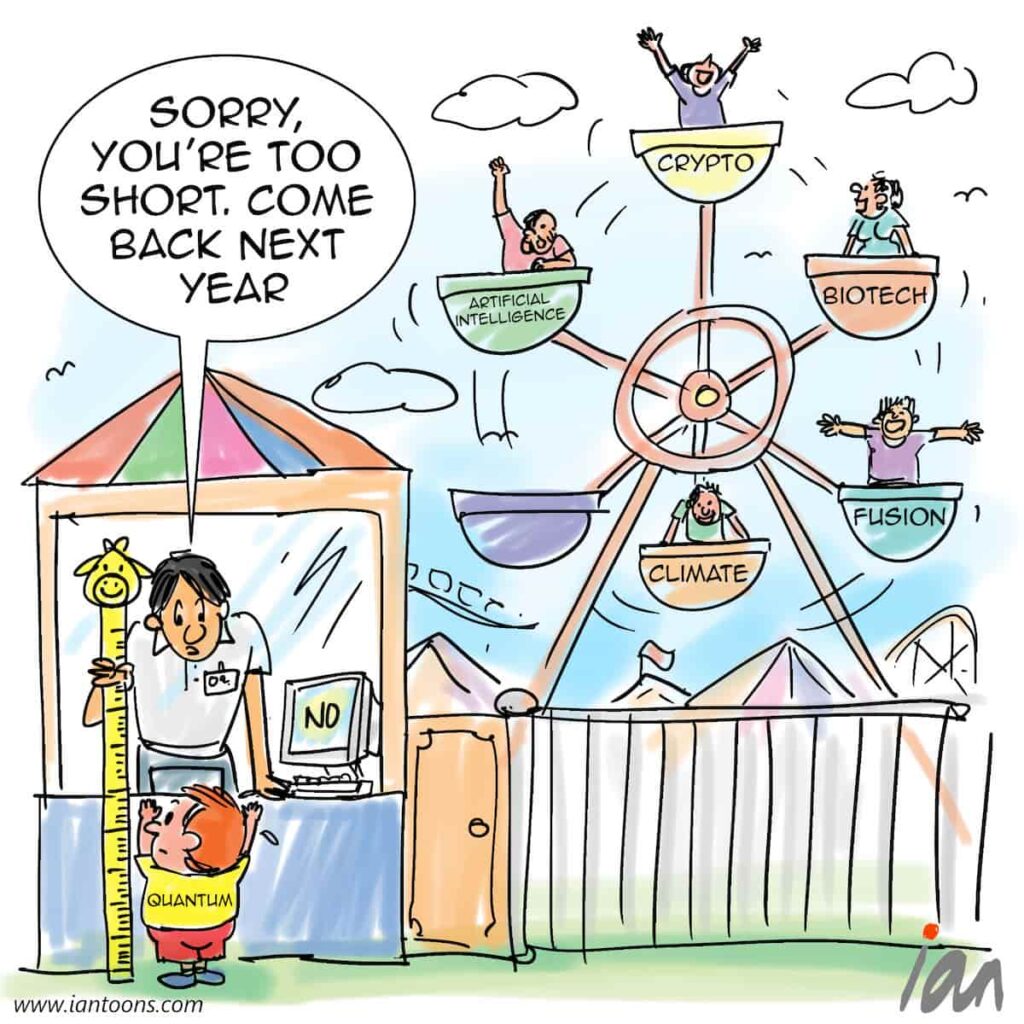

The secondary impact of these changes are likely to see more solo partner venture capital funds and new emerging market funds that use a big data approach to screen for founders (e.g. Infrastructure Ventures).

14

2

2

Sources:

Douglas B. Laney (Feb 22, 2024) – Investors Have Got Your Number: Navigating The Data-Driven Shift In Venture Capital – Forbes

Andre Retterath (2024) – Data-Driven VC Landscape 2024 – Data Driven VC