Rodeo

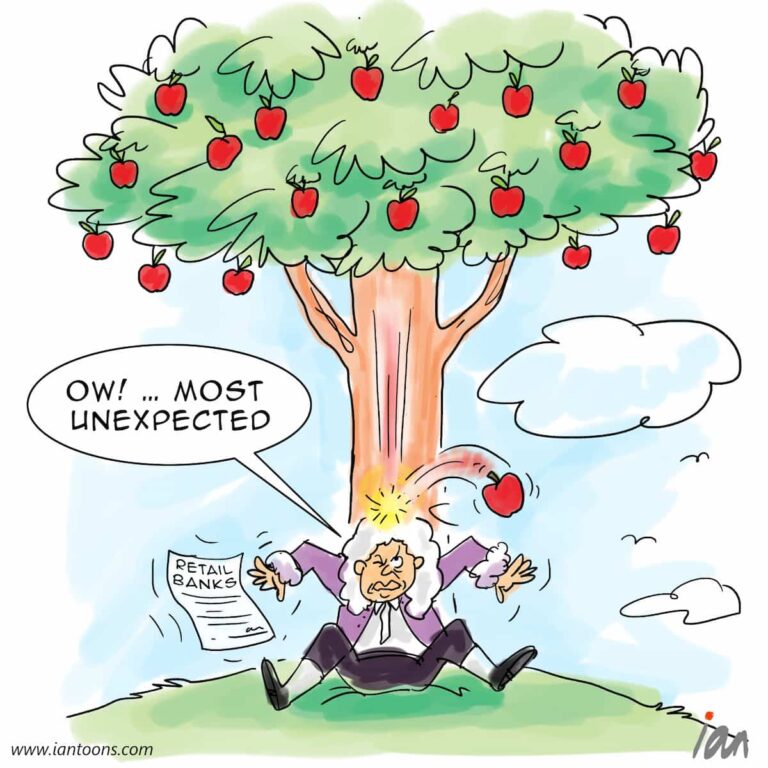

“Rodeo” – a cartoon that illustrates why Fintechs and DeFi companies should view Risk Management as a core competency.

Throughout the history of finance, many banking products are provided at a loss or at cost, but loans provide cash flow and enable banks to build up assets on their balance sheet. It is therefore not surprising that new banks and crypto firms got into the lending business.

For example, Celsius’ crypto loans allowed users to borrow against their crypto for fiat or stablecoins.

With lending rates as low as 1% APR and leverage up to 50% LTV, Celsius crypto loans were presented as a unique opportunity for consumers.

But, we now know that this all seemed too good to be true.

This car crash has attracted the attention of regulators, which is likely to lead to legislation with lots of unintended consequences.

However, the Fintech industry has the opportunity to step in and create risk management standards for lending or for other exotic banking products.

As Simon Taylor remarks in his Fintech Brainfood blog, we need to see new startups “competing on how effectively they can help a Neobank, Fintech company, Incumbent or web3 wallet manage risk.”

7

0

0