Seeking Alpha

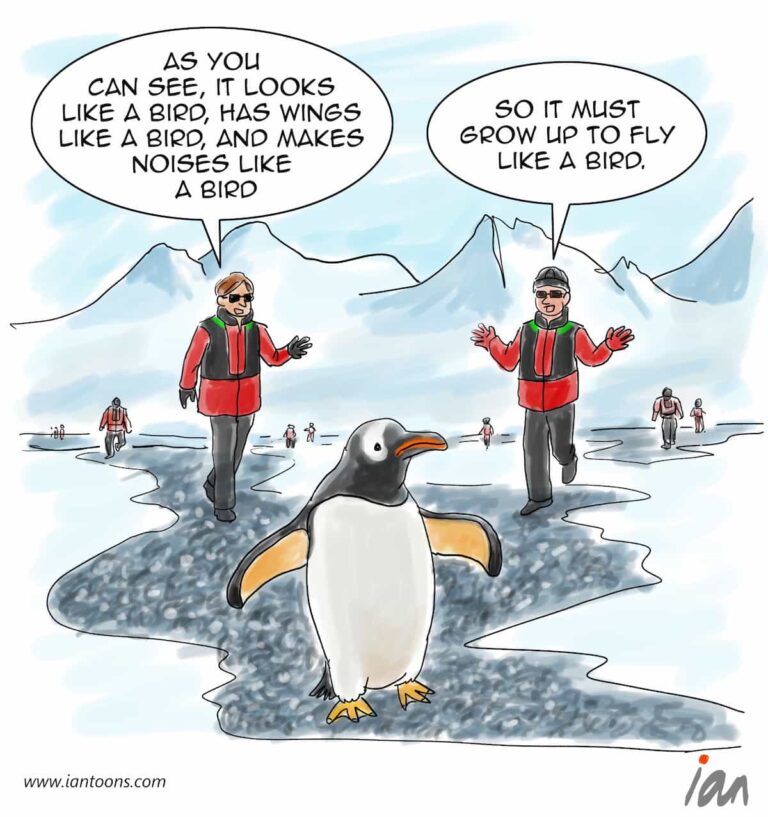

“Seeking Alpha” – a cartoon that illustrates how blockchain staking provides consumers with a new globally accessible investment product.

In 2019, the blockchain industry realized that they could create a new investment product on the back of staking. Until then, staking was an operational activity that was used as alternative consensus algorithms aimed at addressing the limitations and challenges of the Proof of Work (PoW) system used by Bitcoin.

Exchanges like Coinbase and Kraken allowed consumers to earn rewards by participating in the validation and securing of a blockchain network using their cryptocurrency holdings.

As of early 2024, the global staking market had reached approximately $187.9 billion in total market capitalization, with annual staking rewards back to consumers amounting to around $5.85 billion.

Over the past five years, the average yield from staking has varied depending on the specific cryptocurrency and market conditions, with staking yields ranging from about 1% to 15% annually.

In April 2024, EigenLayer launched a further innovation by enabling Ethereum validators and stakers to “re-stake” their assets onto other emerging networks and applications, effectively enhancing the security and utility of their already staked ETH.

For chains like Polkadot, this has meant consumers that might get staking yields around 10% to 14% annually, with regular re-staking, the compounded yield could exceed 15% depending on the frequency of re-staking and the stability of the staking rewards.

Perhaps the biggest beneficiaries of all of this will be consumers in the Global South, who often use crypto currency as a way for money transfer and can now use staking as a dependable investment product.

16

0

1