Strike

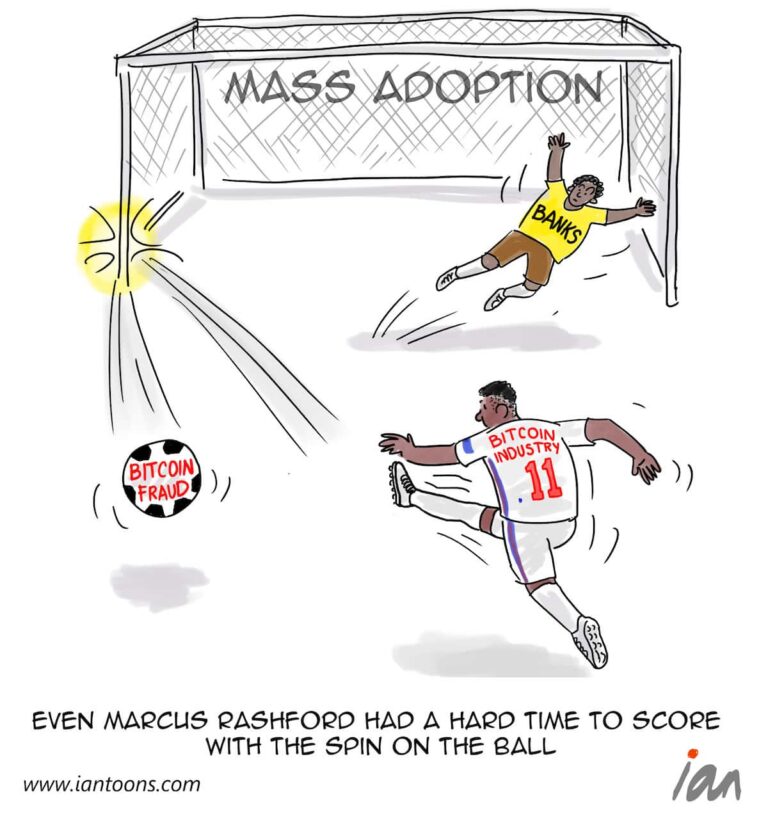

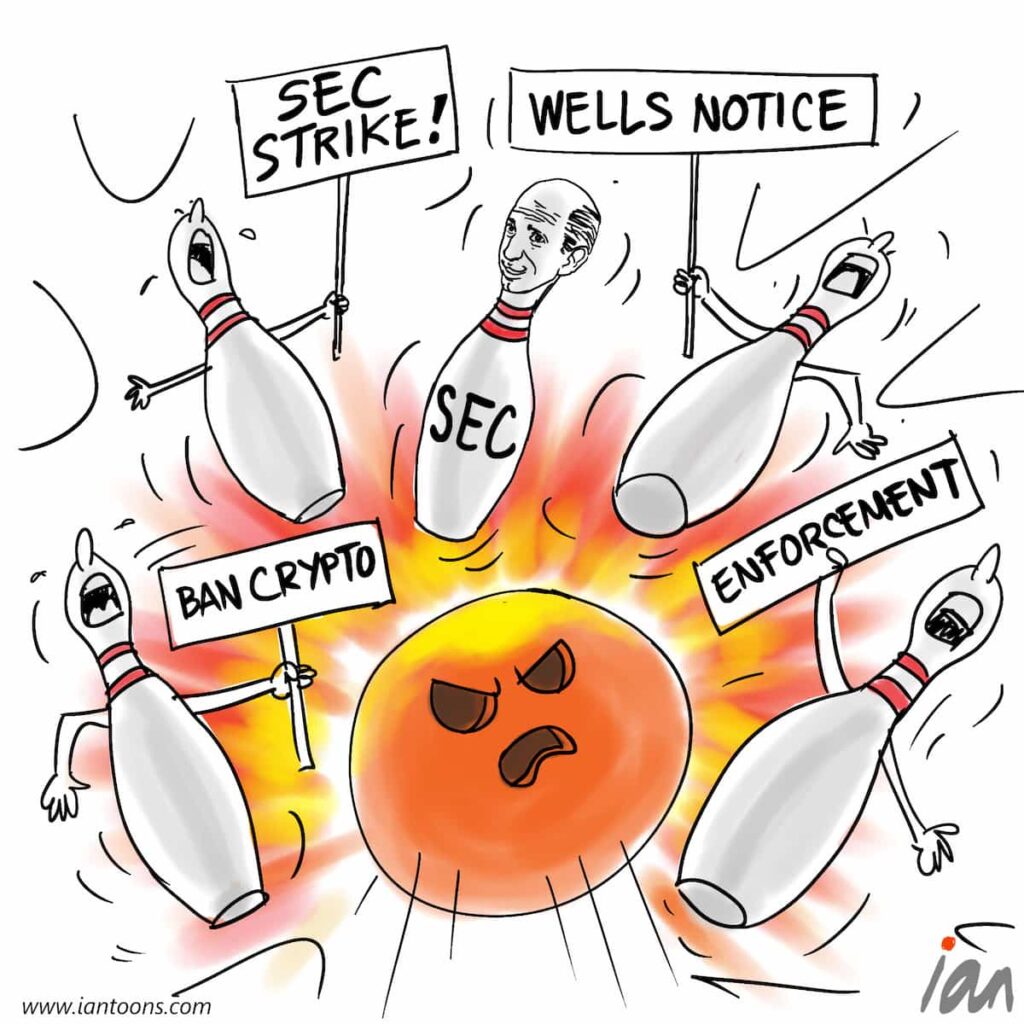

“Strike” – a cartoon that illustrates how the anticipation of the new US administration is already changing the composition and stance of the SEC.

In the aftermath of the FTX blow-up, Gary Gensler was appointed chair of the SEC in 2021 and immediately called on Congress to give him more powers to regulate the “wild west” crypto-sector, saying that it was “rife with fraud, scams and abuse.”

However, rather than create clear direction for good actors to follow, the whole industry was tarred with the same brush and many firms decided to go offshore.

In the last couple of years, the SECs actions have kept hitting the wall where judges threw out the enforcement action, which was turning the sentiment towards the industry even before Trump’s pro-crypto election win occurred.

Since November 6, the pace has started to pick up. In mid-November a federal judge in Texas delivered a sharp rebuke to the SEC’s crypto policy, ruling its application of securities law to decentralized finance (DeFi) projects exceeded its authority.

The Blockchain Association‘s compelling argument led the court to dismiss the case without trial. Furthermore, last week the infamous Gary Gensler resigned, which many predict will usher in a wave of new wave of adoption and investment in the industry, already shown by Bitcoin touching just under $100K this week.

“Chair Gensler’s tenure at the SEC has been marked by missed opportunities,” said Sheila Warren, who runs the Crypto Council for Innovation. She argued that Gensler has left U.S. businesses “operating in the dark” by leaning into enforcement rather than regulation. “A fresh start at the SEC is essential for the future of innovation in this country.”

11

0

1

Sources:

Leo Schwartz (Nov 21, 2024) – SEC Chair Gary Gensler resigns, leaves legacy of division and crypto feuds – Fortune

Dave Birnbaum (Nov 24, 2024) – Bitcoin Blasts Toward $100,000 And It’s Just Getting Started – Forbes

Ryan Adams, David Hoffman – Bankless’ Podcast