Trying to Exit

“Trying to Exit” – a cartoon that illustrates how the last four years have been particularly challenging for private companies trying to go public on the stock market (otherwise known as go through an Initial Public Offering, IPO).

In terms of capital raised and number of IPOs, 2021 stands out.

Approximately 2,040 companies went public in that year resulting in $841BN capital raised in the United States, driven by a surge in tech companies.

Some of the big IPOs of 2021 included UiPath, Rivian, and Coinbase (of which only Coinbase is the only one currently trading above its IPO price). In 2024, there were 1,249 exits resulting in $149BN capital raised.

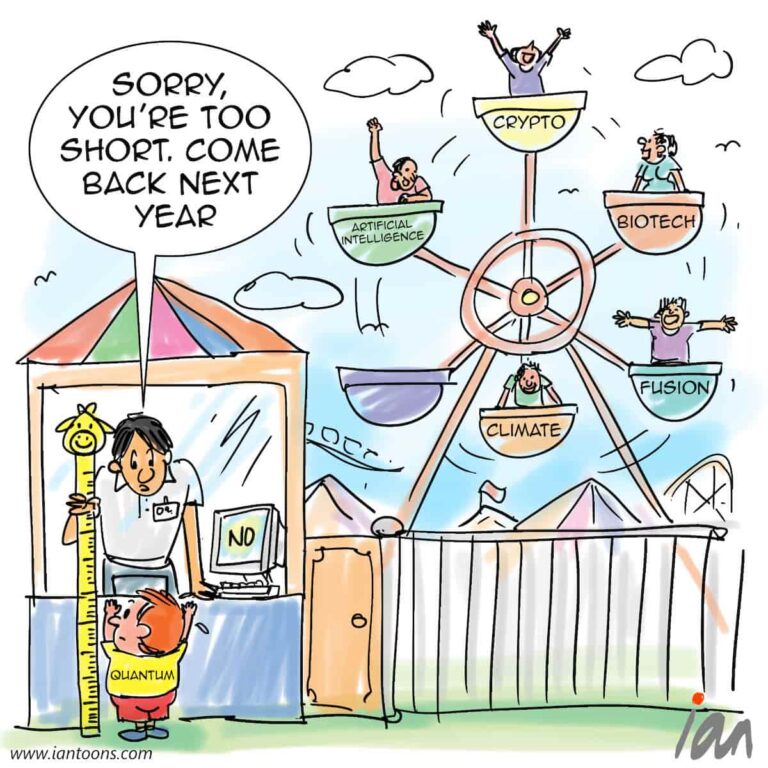

While 2021 was an anomaly compared to prior years, the number of private companies that have been building up since 2021 is creating a significant backlog of unlocked value. According to a Pitchbook-NVCA report, the total value of privately held unicorns is now $2.7TN, which is roughly the size of the GDP of France!

Many private companies have spent the last couple of years focusing on profitability, trying to get to over $100M in revenue and growing at 25% annually. What might help unleash this wave of exits is the change in US administration.

President Trump’s picks for some of the key regulatory agencies (e.g. Andrew Ferguson replacing Lina Khan at the Federal Exchange Commission) should help make a better dealmaking environment compared to the Biden administration.

Overall, the success for the IPO market in 2025 will hinge on the performance of the first movers.

A successful start will boost valuations, unlock liquidity for investors, and encourage more companies to go public.

29

4

1