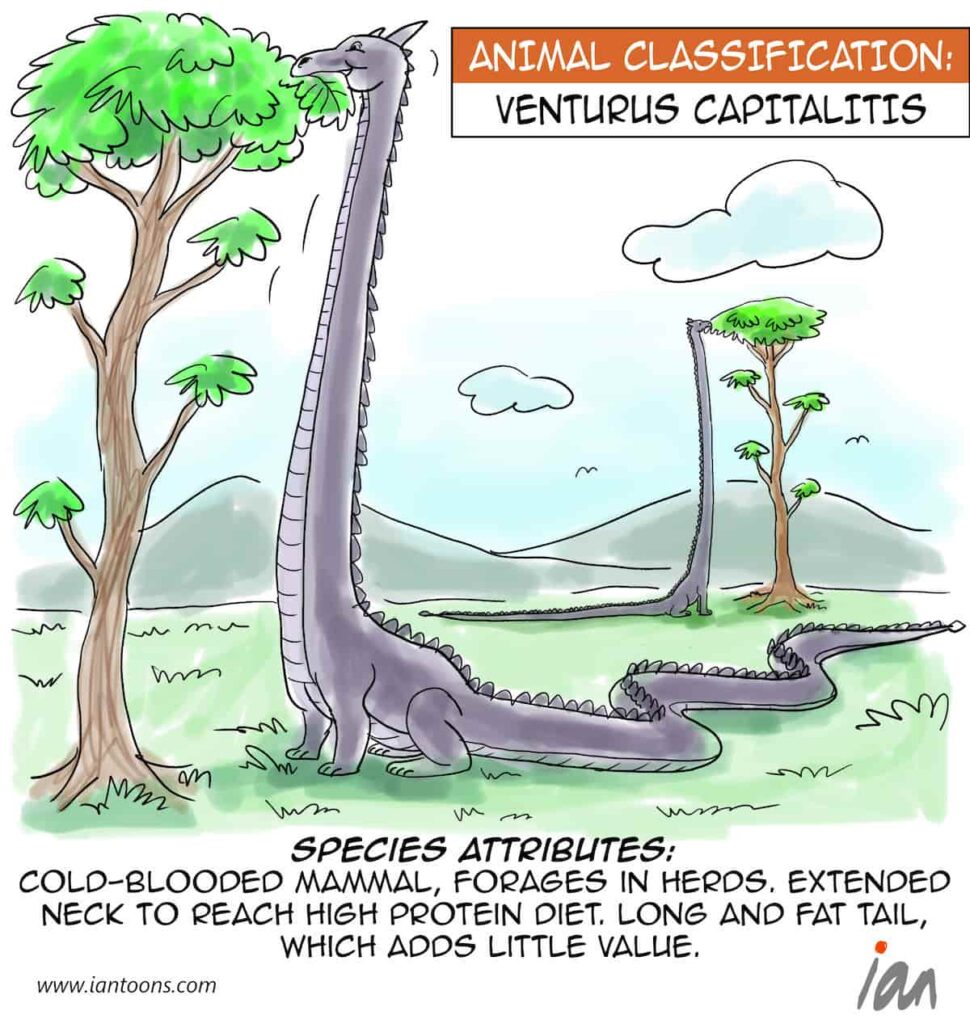

Venturus Capitalitis

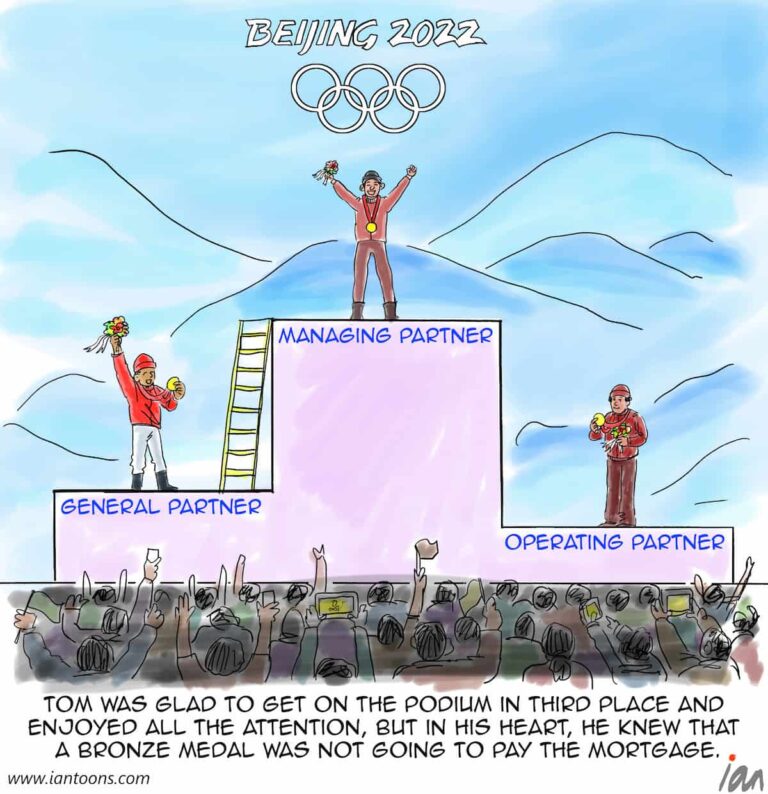

“Venturus Capitalitis” a cartoon that illustrates how the Power Law of returns model drives the industry.

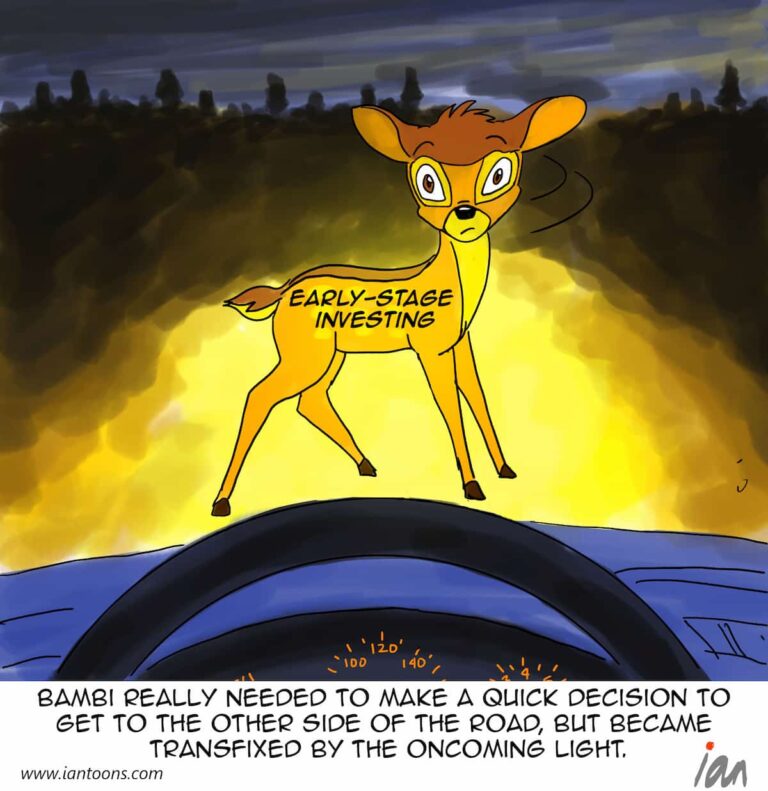

VC funds do not follow a normal distribution of investment returns, they follow a power law curve, which is when the distribution of returns is heavily skewed towards the top funds.

These funds attract the best entrepreneurs and have the capital to keep investing through the lifecycle of a startup.

As Marc Andreessen, the founder of a16z, shared “each year, of the 4,000 technology startups seeking VC funding, only 200 (or 5%) are seriously fundable, with “15 of those generating 95% of all economic returns.”

This results in a long tail of VC funds that make no money or lose money for their investors, which leads to them being unable to raise capital and ultimately close down.

15

6

1