ICOs failed

24

10

4

“Ian this is truly fantastic!”

Executive HR Advisor

Executive HR Advisor“According to Forbes research 90% of any startups will anyway fail notwithstanding their fundraising method. So, it is useless to target one fundraising method only. In fact, taking this global statistics into consideration 64% is a very good KPI, however we would need to study this number 3 years later again.

Meanwhile, it is true that raising millions for just an idea is not sustainable. Real projects with real teams should be invested in, not fancy looking websites and pitch decks. I can tell this based on our experience at 7marketz Inc. (acquired) both on traditional and Crypto markets side.” Polygraf AI | use any AI anonymously | responsible AI | Patent holder

Polygraf AI | use any AI anonymously | responsible AI | Patent holder“”pivoting to raise money through Securitized Token Offerings” Oh gosh, here we go again. I thought people had learned by now that the STO is not the answer to a less popular ICO industry. I feel like I am back in November 2018 when everyone changed their profiles from ICO Advisor to ICO/STO Advisor. They may “pivot” and then quickly realise they do not have the funds, knowhow or the patience to create a security offering.”

Satoshi Island | Operations

Satoshi Island | Operations“There’s a little to no connection between ICO and STO except for both being fundraising instruments. STO is entirely a different animal and not a magic bullet which would magically solve issues of ICOs. In fact, STOs are way more expensive and time-consuming and involve in a lot of preparation (which is a good thing most of the time).

It is not only difficult but also infeasible or impossible to conduct STO at a mass scale if one thinks both are same. No sir, you need to comply with every country and jurisdictions you investors are (or will be), not just United States. There MAY be restrictions on who can invest and cap on number of participants. As much as I love regulations and compliance, I pretty much doubt if STO is going to be the answer people are looking for.

Only my opinion and not a legal, financial, or investment advice because I do not have qualifications nor registered as an advisor in any capacity anywhere.” Angel Investor in AI Startups / Founder / Building Data Pipeline for RAGs / Generative AI / Web3 / Blockchain

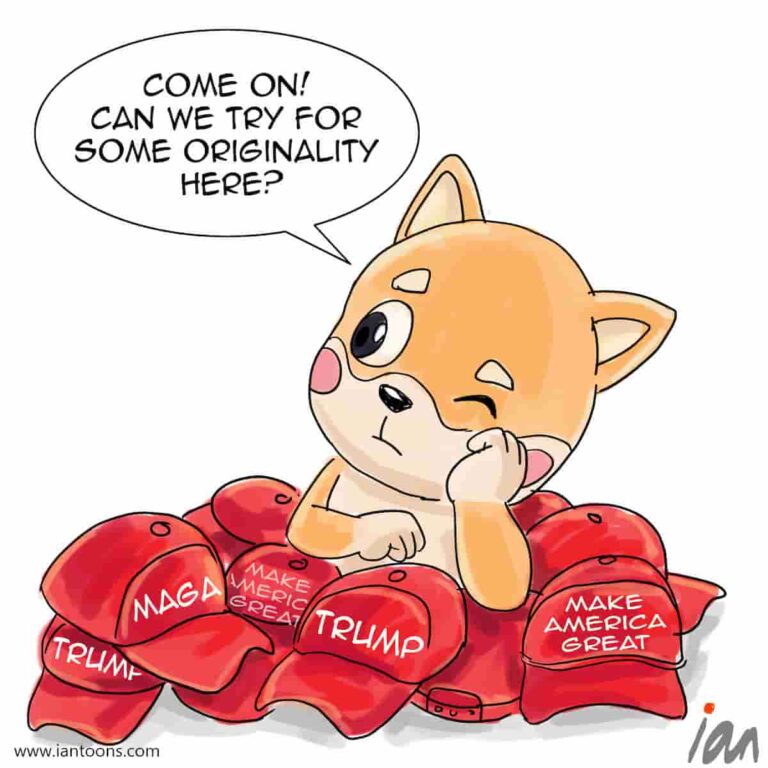

Angel Investor in AI Startups / Founder / Building Data Pipeline for RAGs / Generative AI / Web3 / Blockchain“Great drawing!”

Fintech Regtech Deal Manager at FLO Capital

Fintech Regtech Deal Manager at FLO Capital“The ICO market may come back — there is a place for a funding vehicle that draws capital to a particular asset or economic driver of a company. But they will only succeed when there is a sound valuation and solid business purpose behind the vehicle. STOs are more flexible than selling common stock and could actually become the new IPO market. Right now both are the wild, wild west. Lots of risk — and lots of opportunity. In my opinion.”

Founder, COO @ Studious | CFA, AI-enabled study support

Founder, COO @ Studious | CFA, AI-enabled study support“So Ian do you think this ICO/STO fidget has dried up and closed permanently or will the doors reopen once crypto’s begin their resurgence?”

Move emerging technologies from around the world to around the world to conquer new markets and solve old/new problems.

Move emerging technologies from around the world to around the world to conquer new markets and solve old/new problems.“So there’s 26% more left to fail until they reach startup-level success rates. STOs are just a different way to package, albeit I’d argue no different from good old equity crowdfunding, which had been around for some time before STOs”

Go To Market | 3x 0->1 | Builder

Go To Market | 3x 0->1 | Builder