Long Shadow

The bull is back but slow to share,

While memecoins soar on retail flair.

Yet ETH and GameFi miss their flight,

As Bitcoin hogs the ETF light.

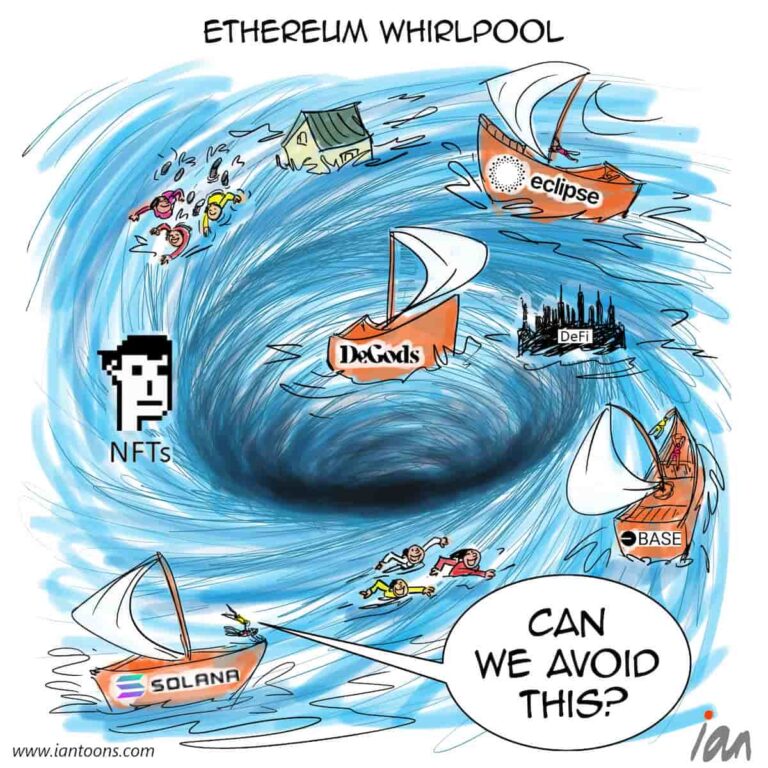

“Long Shadow” – A cartoon that illustrates how the upcycle in crypto this time is showing a much more uneven distribution.

The blockchain industry has experienced four major bull cycles since 2011, each driven initially by Bitcoin, whose dominance typically rises above 60% during early phases, before capital rotates into altcoins, leading to broad market rallies where total crypto market cap has historically surged over 1,000% from cycle bottoms.

For example, in the 2021 cycle, Ethereum rose over 4,000% from its March 2020 low as DeFi and NFT narratives gained momentum following Bitcoin’s lead. In the current cycle, capital rotation into altcoins has been a lot slower to take-off and much more uneven.

For example, meme coins like PEPE and dogwifhat surged over 10x, helping push the meme sector to a $120B market cap, while Real World Asset (RWA) tokens reached $41B as institutional interest grew. In contrast, Ethereum is down from its 2024 high of $4,090 to ~$2,490, and underperforming sectors like SocialFi and GameFi (e.g., GALA and Sandbox with sub-$1.2B market caps) have seen limited traction despite earlier hype.

Unlike past cycles, the 2024–2025 bull run has seen institutional capital and regulatory clarity concentrate around Bitcoin, fueled by spot ETFs, while altcoin performance remains fragmented due to weak sector narratives, macro uncertainty, and limited retail capital rotation.

However, with Bitcoin still under $110,000, John Glover the Chief Investment Officer at Ledn, believes that we are still in the early stage of the bull cycle to know if this time is any different – “altcoins typically follow Bitcoin’s upward trends, but need a sustained breakout above $110,000 to spur growth.”