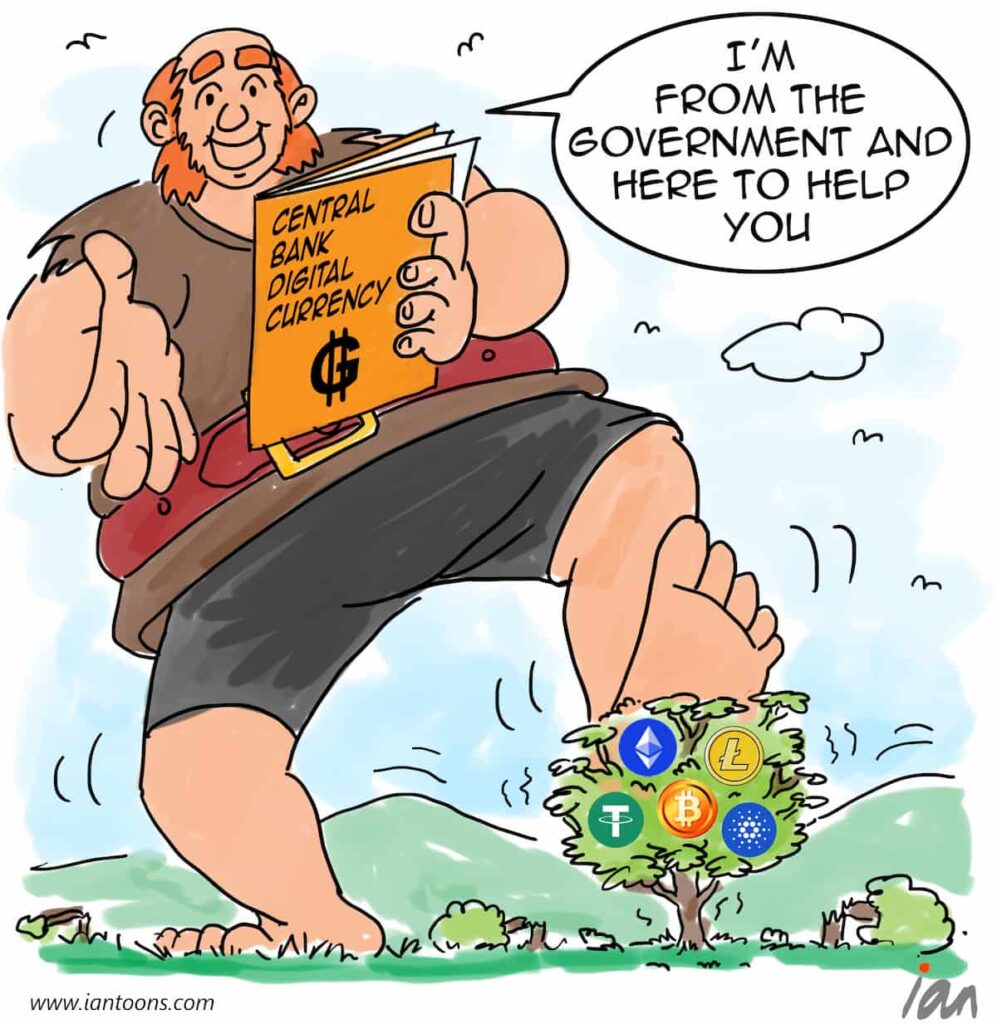

Unintended Consequences

“Unintended Consequences” – a cartoon that illustrates how the surge in government interest to launch their own digital currencies might be detrimental to consumers and the overall industry.

Currently,105 countries (representing 95% of global GDP) are in one way or another involved with CBDCs (Central Bank Digital Currencies).

These digital currencies are designed to manage national currencies in an entirely digital form but through permissioned, rather than permissionless ledgers.

China is one of the countries furthest ahead with its e-CNY, already in circulation for paying for lottery tickets and is shortly to be rolled out for retail payments.

Governments highlight the advantages of a state-backed digital currency, particularly the stable nature of the currency and it will prevent bad actors from money laundering etc. However, some of the CBDC advantages have some quite chilling consequences for consumers, most notably privacy.

As all transactions will be recorded on a ledger, so governments will have the ability to view every citizen’s purchase decisions forever and be able to easily stop a user’s access to their money.

For the nascent digital currency and Web 3.0 industries, one of the unintended consequences is that governments will likely tailor legislation to favor their digital currency, crowding out innovation.

While there might be inherent advantages for authoritarian regimes to use CBDCs to unseat the dollar-dominated world, liberal democracies should tread carefully.

12

0

0