Fear Gauge

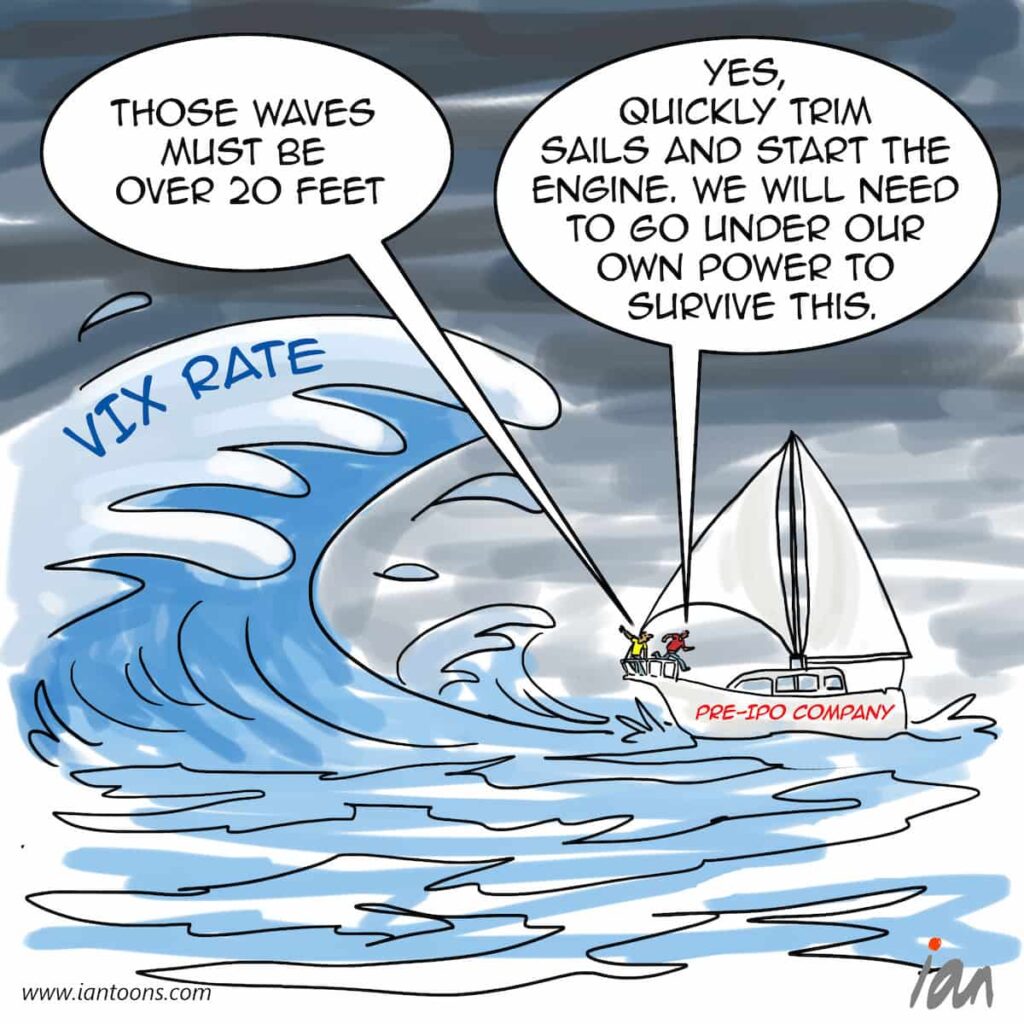

“Fear Gauge” – a cartoon that illustrates how uncertainty in the stock market is keeping companies from going public.

Public markets use the CBOE Volatility Index (“VIX”) or widely known as the “Fear Gauge,” which analyses the S&P and the options market, to determine market volatility.

Currently, there is a healthy pipeline of over 1,200 unicorns that are waiting to go public, but according to Morgan Stanley we are now over 250 days since a tech IPO of over $50 million, beating the records set after the 2008 financial meltdown and the dot.com bust in the early 2000s.

The Financial Times reported that overall U.S. IPO volumes are down 94% year-over-year, with just $7 billion raised so far compared to $110 billion at this time last year.

Companies are hesitating on going public because the market can experience huge swings, caused by macro-economic factors that might have nothing to do with a tech company’s business.

Over the last six months, the VIX index is hovering around 25-33. NYSE’s president Lynn Martin remarked that, “until the VIX is consistently below 20, I don’t think the floodgates are going to open for those companies who have been talking to us and we’ve been working with for a while.”

15

0

0