Less Fun

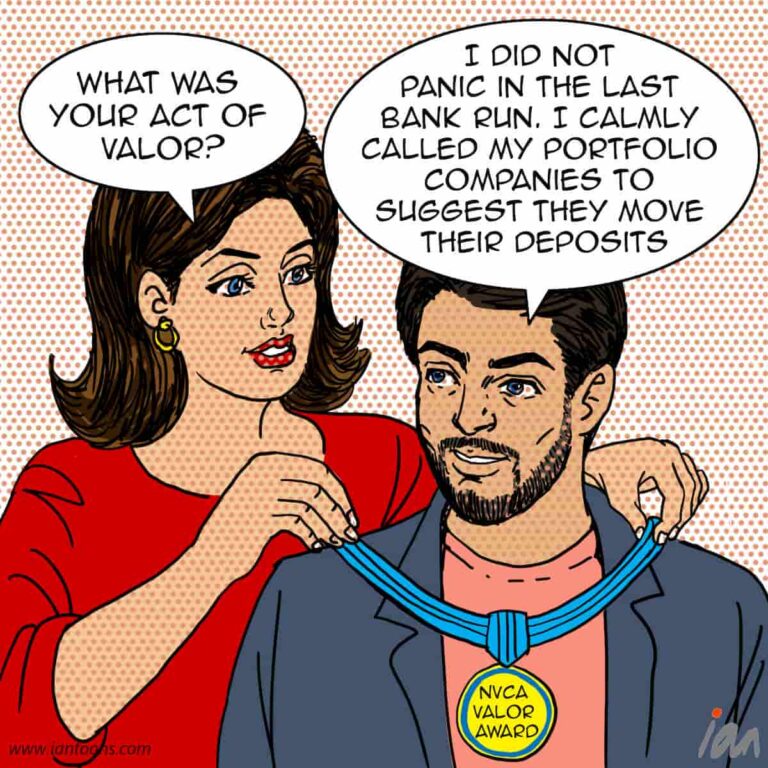

“Less Fun” – A cartoon that illustrates how venture capital as an asset class is starting to lose its positive perception among fund investors.

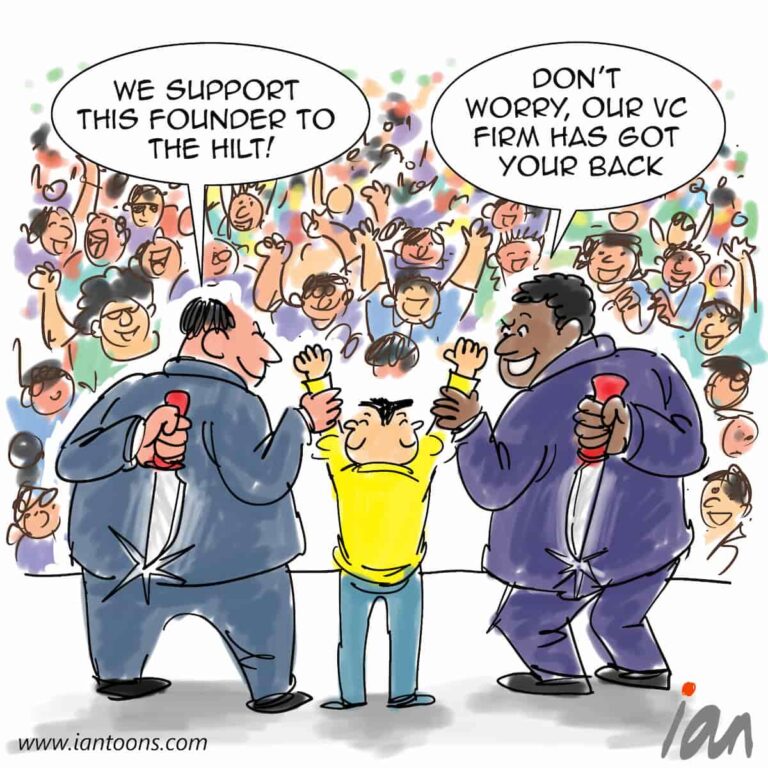

For years, venture capital enjoyed an attractive public image. From the outside, it looked like a club of ex-Ivy Leaguers with a smattering of startup experience, making million-dollar bets from plush offices with long time horizons and little short-term accountability. Management fees were generous, failure was abstract, and the uniform was universal … chinos and sleeveless puffer vest. Venture was not just an asset class, it was a lifestyle brand.

It did not start that way. Venture began as a cottage industry, with Arthur D. Rock’s backing of Fairchild Semiconductor in the 1950s proving that risk capital paired with technical ambition could create new industries. The dot-com boom expanded the model, and the 2010s industrialized it. Pattern matching and tight founder networks created trust loops that worked when capital was scarce and information uneven. Returns were driven by judgment, not deployment speed.

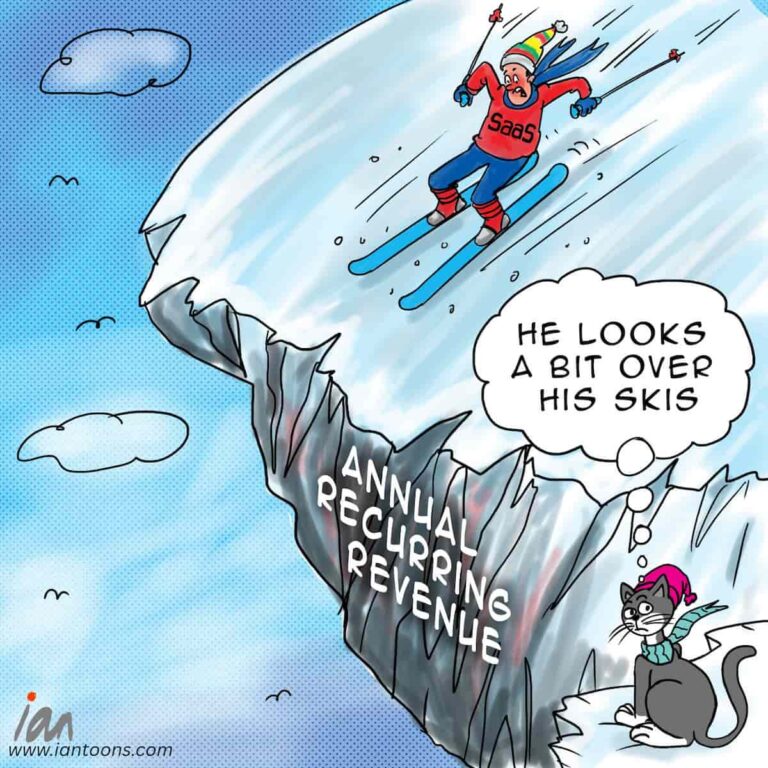

Then money arrived in force. Venture shifted from niche to default allocation for many pension funds or even sovereign wealth funds, fueled by zero interest rates and institutional hunger for growth. Funds grew larger, hold periods extended, and firms expanded into new asset classes looking more like mutual funds. The industry’s center of gravity moved from discovery to deployment and the math has started to break, which the data now shows. Venture fundraising in 2024 fell to its lowest level since 2017, and 2025 is tracking flat again. US venture exit value remains more than 50% below its long-term average, and median time to exit has stretched beyond 11 years.

Indicative of the mood is the shift in talent to leave the industry. For example, in January 2026, former Sequoia partner Kais Khimji gave up a prestigious seat in the industry and launched Blockit AI, a 24/7 scheduling assistant. However, this type of change may be the best signal of all for limited partners looking to deploy capital into the venture industry. As Fred Wilson wrote in 2009, “investing when things are going from bad to worse is the right time to invest.”