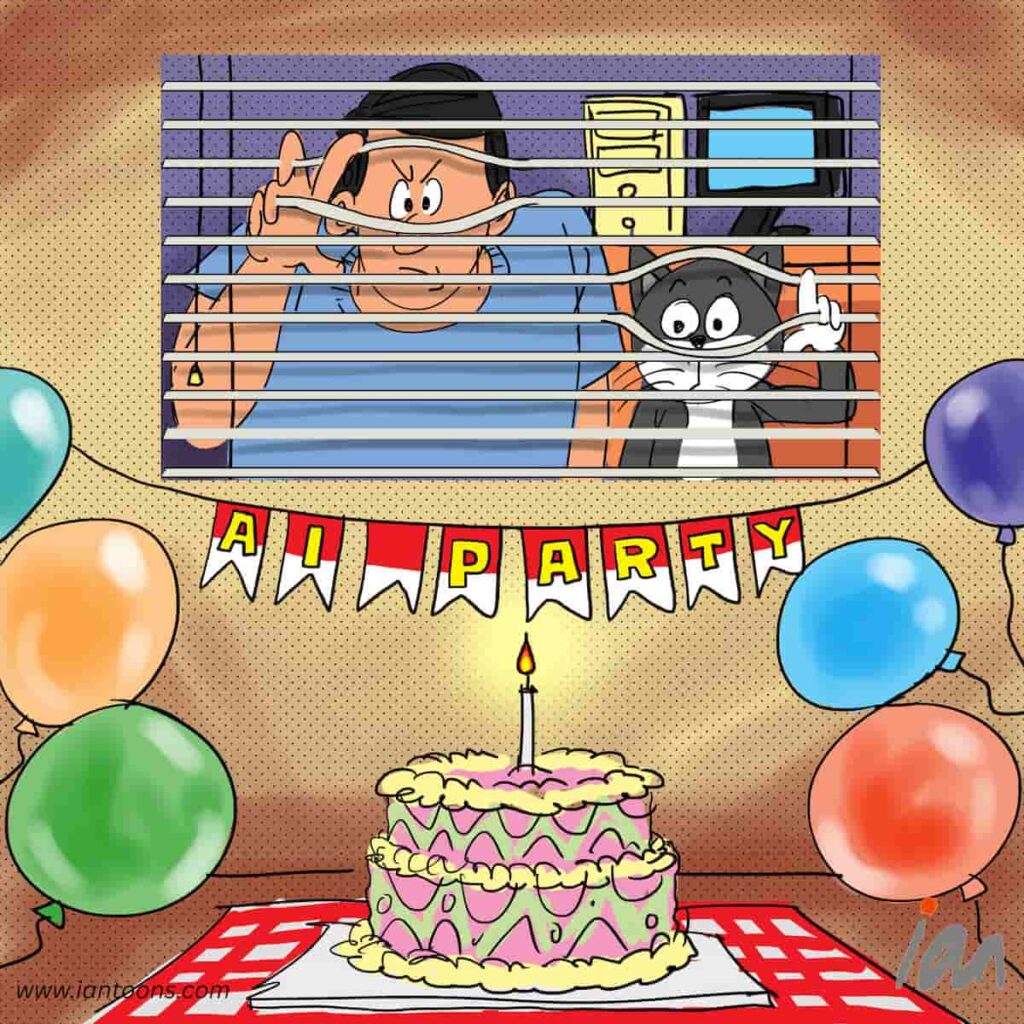

Peering

Peering – A cartoon that illustrates the disparity around venture capital funding at the moment.

Venture capital was created to do what banks would not. In the middle of the 20th century, traditional lenders avoided unproven founders, unfamiliar technologies and markets without collateral or predictable cash flows. Venture stepped in as a deliberate alternative, backing ideas that looked unreasonable at first glance but carried the potential to reshape entire industries.

In 2025, that bargain looks increasingly one-sided. U.S. venture deal value reached $339 BN, nearly matching the highs of the last cycle. On the surface, it looks like a recovery, but underneath the concentration is stark. Half of all venture dollars invested this year went into just 0.05% of completed deals.

At the late stage, capital piled into familiar names like OpenAI and Databricks, with multi-billion-dollar rounds absorbing an outsized share of total dollars. But the concentration doesn’t stop there. At earlier stages, companies such as Inflection AI, Adept AI, xAI, and Character.AI raised what would historically be considered growth-stage capital at or near the seed stage. Enormous checks written to a very small number of teams.

PitchBook data shows that outside AI, dealmaking remains muted. A majority of first-time financings now go to AI companies, not because innovation elsewhere has disappeared, but because capital has converged on a narrow set of narratives and firms. Exit value is still only 34% of its 2021 peak, and fundraising reflects that strain, with new commitments falling to $66 BN as LPs wait for liquidity.

The same dynamic plays out at the firm level. Andreessen Horowitz’s $15 BN fundraise stands in sharp contrast to the struggle faced by emerging managers. The result is an industry where a small group is firmly inside the room, while much of the startup ecosystem stands outside, peering through the blinds at a party they are not invited to.

As Peter Thiel once put it, “brilliant thinking is rare, but courage is in even shorter supply than genius.” If venture capital loses the courage to fund ideas outside today’s consensus winners, it risks becoming as cautious and exclusionary as the banks it was meant to replace.