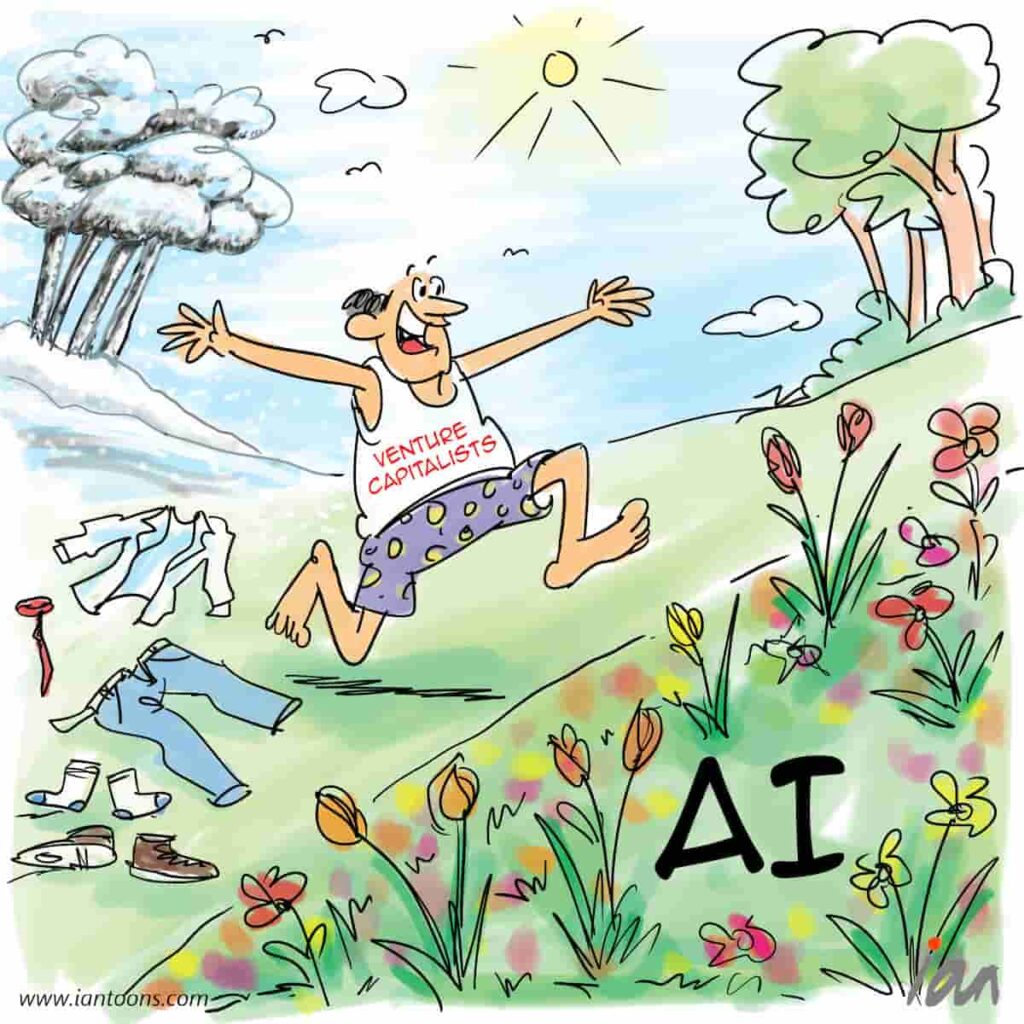

Spring Fever

“Spring Fever” – a cartoon that illustrates how the market appears to be investing in anything that moves with letters “AI” in it, which suggests some venture capitalists are becoming unhinged from a sound investment strategy.

Psychiatrists have noted that symptoms of mental illness often become worse during the spring season, perhaps caused by sudden increase in the duration and amount of sunlight as a possible cause of this phenomenon.

In the last couple of months, we have seen Sam Altman on a trip to the Middle East trying to raise $7 Trillion to reshape the computer chip industry to support AI applications and Saudi Arabia launch a $40 Billion venture fund focused on AI.

Meanwhile, Y Combinator, the Palo Alto-based accelerator, saw over-subscribed interest from VCs in their latest cohort, of which 50% of the startups were working with AI. The question is how much of this capital will see return from the billions invested.

A useful guide is to review other technology waves and see what was successful during their evolutionary journey.

While the application layer (e.g. ChatGPT) steals the spotlight, the picks and shovels are critical aspects of infrastructure investments that have consistently delivered higher overall returns.

These are the enablers that support and facilitate the growth of applications, which in other technology waves were cloud infrastructure providers, cybersecurity firms and data analytics companies. Perhaps this time the laws of gravity will change and over-investment will match rising demand, but don’t bet on it.

22

6

2