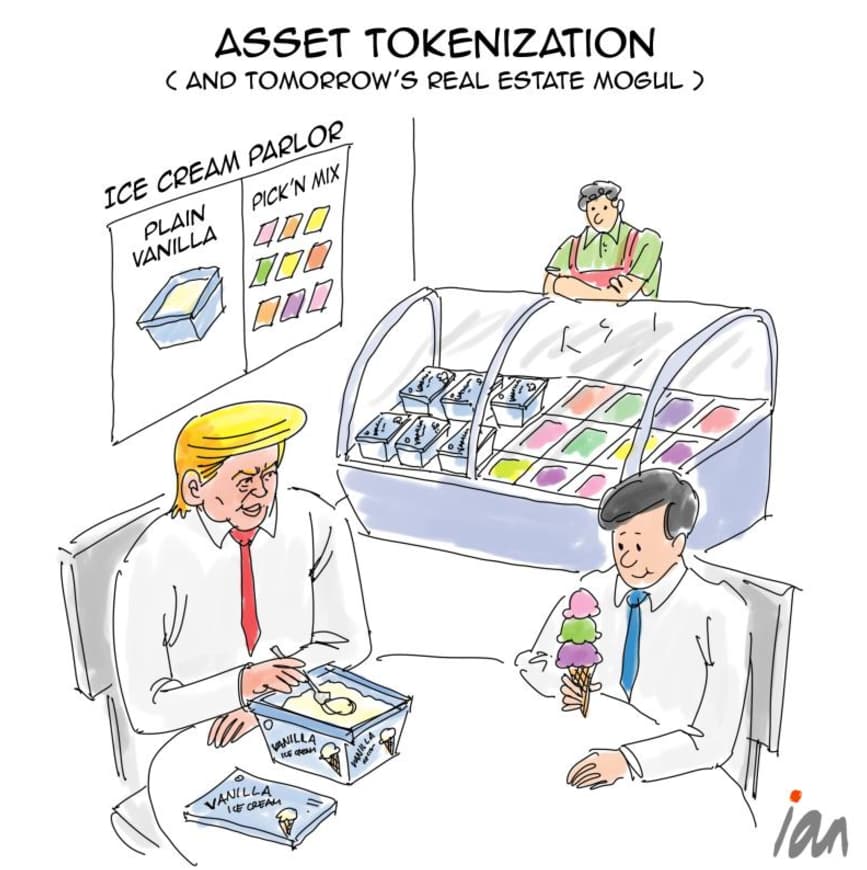

Asset tokenization

Historically, real estate moguls acquired assets by leverage through large bank loans.

However, this model takes time to build a portfolio of assets and can often lead to bankruptcy.

With asset tokenization, the young mogul of tomorrow can build a real estate portfolio by owning fractions of multiple property assets, which diversifies the risk and lowers the entry point to invest in real estate.

17

2

0